Stock market investment for beginners introduces the basics of investing in stocks, providing a solid foundation for those new to the world of investments. From understanding the market to building a diversified portfolio, this guide covers essential concepts to kickstart your investment journey.

Understanding the Basics of Stock Market Investment

Investing in the stock market can be a lucrative way to grow your wealth over time. However, before diving in, it’s essential to understand the basics of how the stock market operates and the key concepts involved.

What is the Stock Market and How Does it Function?

The stock market is a platform where investors can buy and sell shares of publicly traded companies. It serves as a marketplace where companies raise capital by issuing stocks, and investors can potentially profit from the companies’ success. Stock prices are determined by supply and demand, with buyers and sellers negotiating prices in real-time.

Concept of Stocks and How They are Traded

Stocks represent ownership in a company and are issued in the form of shares. When you buy shares of a company, you become a partial owner and can benefit from the company’s profitability through dividends or capital appreciation. Stocks are traded on stock exchanges, where buyers and sellers come together to execute transactions.

Importance of Research and Analysis Before Investing

Before investing in the stock market, it’s crucial to conduct thorough research and analysis. This includes studying the company’s financials, understanding its business model, analyzing industry trends, and assessing market conditions. By doing your homework, you can make informed investment decisions and potentially minimize risks.

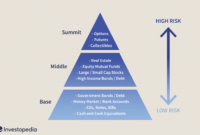

Types of Investments in the Stock Market: Stock Market Investment For Beginners

Investing in the stock market offers various options for individuals looking to grow their wealth. Understanding the different types of investments available can help beginners make informed decisions when entering the market.

Stocks

Stocks, also known as equities, represent ownership in a company. When you buy a stock, you are purchasing a small piece of that company. Stocks offer the potential for high returns but also come with high risk due to market fluctuations. Examples of well-known companies that offer stocks include Apple, Amazon, and Microsoft.

Bonds

Bonds are debt securities issued by companies or governments to raise capital. When you invest in bonds, you are essentially lending money to the issuer in exchange for periodic interest payments. Bonds are generally considered lower risk compared to stocks but offer lower returns. Examples of well-known companies that issue bonds include IBM, Coca-Cola, and the U.S. Treasury.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. By investing in mutual funds, individuals can access a variety of assets without needing to purchase them individually. Mutual funds offer diversification and professional management but come with fees and expenses. Examples of well-known mutual fund companies include Vanguard, Fidelity, and BlackRock.

Setting Investment Goals and Strategies

Setting clear investment goals is crucial for any investor as it helps provide direction and focus for their investment activities. By having specific objectives in mind, investors can better tailor their strategies to achieve their desired outcomes. Additionally, understanding one’s risk tolerance and time horizon is essential in determining the appropriate investment approach.

Different Investment Strategies

- Value Investing: This strategy involves looking for undervalued stocks that are trading below their intrinsic value. The goal is to buy these stocks at a discount and hold them until their true worth is recognized by the market.

- Growth Investing: Growth investors focus on companies with strong potential for future growth. They typically invest in companies that are expanding rapidly and have the potential to deliver high returns over time.

- Dividend Investing: Dividend investors prioritize stocks that pay out regular dividends. These investors seek to generate a steady income stream from their investments, often reinvesting dividends to compound their returns.

Influence of Risk Tolerance and Time Horizon

- Risk Tolerance: Understanding your risk tolerance is crucial as it determines how much volatility you can handle in your investment portfolio. Investors with a high risk tolerance may be more inclined to invest in higher-risk assets, while those with a low risk tolerance may prefer safer investments.

- Time Horizon: Your time horizon refers to the length of time you plan to hold your investments. Generally, investors with a longer time horizon can afford to take more risks, as they have more time to ride out market fluctuations and benefit from long-term growth potential.

Building a Diversified Portfolio

Building a diversified portfolio is essential for investors, especially beginners, as it involves spreading investments across different asset classes, industries, and geographic regions to reduce risk and enhance potential returns.

Importance of Diversification

Diversification helps to minimize the impact of market volatility on your overall portfolio. By spreading your investments, you can reduce the risk of losing all your capital in case of a downturn in a particular sector or asset class.

- Diversification lowers the correlation between investments, ensuring that the performance of one asset does not significantly impact the entire portfolio.

- It allows you to benefit from the growth potential of various sectors and industries, thus increasing the chances of overall portfolio growth.

- Helps in preserving capital by mitigating the impact of market fluctuations on your investments.

“Don’t put all your eggs in one basket.”

Tips for Building a Diversified Portfolio

To build a diversified portfolio effectively, beginners can follow these tips:

- Asset Allocation: Allocate your investments across different asset classes such as stocks, bonds, real estate, and commodities to spread risk.

- Industry Allocation: Invest in companies from various industries to avoid concentration risk in a single sector.

- Geographic Allocation: Consider investing in different regions or countries to reduce exposure to local economic fluctuations.

- Use Exchange-Traded Funds (ETFs): ETFs provide instant diversification by investing in a basket of securities, making them a convenient option for beginners.

- Regular Rebalancing: Periodically review and rebalance your portfolio to maintain the desired asset allocation and risk level.

Researching and Selecting Stocks

Researching and selecting stocks is a crucial step in building a successful investment portfolio. By analyzing individual stocks, investors can make informed decisions based on key metrics and factors that influence a company’s performance.

Understanding Key Metrics

When researching stocks, investors should pay attention to key metrics such as the Price-to-Earnings (P/E) ratio, Earnings Per Share (EPS), and dividend yield. These metrics provide valuable insights into a company’s valuation, profitability, and dividend distribution.

- P/E Ratio: The P/E ratio compares a company’s stock price to its earnings per share. A high P/E ratio may indicate that the stock is overvalued, while a low P/E ratio may suggest it is undervalued.

- EPS: Earnings Per Share represents the portion of a company’s profit allocated to each outstanding share of common stock. A higher EPS typically indicates a company’s profitability.

- Dividend Yield: The dividend yield is calculated by dividing the annual dividend payment by the stock price. It shows the percentage return on investment from dividends.

Importance of Company Financials and Management, Stock market investment for beginners

In addition to key metrics, investors should consider company financials, industry trends, and management when selecting stocks. Analyzing financial statements, such as income statements, balance sheets, and cash flow statements, can provide insights into a company’s financial health and performance.

It’s essential to research the company’s management team, as strong leadership can drive growth and innovation, while poor management can lead to financial setbacks and underperformance.

Considering Industry Trends

Understanding industry trends and dynamics is crucial in selecting stocks. Investors should assess the competitive landscape, market opportunities, and potential risks within a specific industry to make informed investment decisions.

Risk Management and Monitoring Investments

When it comes to stock market investments, managing risks and monitoring your investments are crucial aspects to ensure the success of your portfolio.

Strategies for Managing Risks

- Diversification: One of the most effective ways to manage risks is to diversify your portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of a single stock’s performance on your overall portfolio.

- Setting Stop-Loss Orders: Setting stop-loss orders can help limit potential losses by automatically selling a stock when it reaches a certain price. This can protect your investment from significant downturns in the market.

- Regularly Reviewing and Rebalancing: It’s important to regularly review your portfolio and make adjustments as needed. Rebalancing can help you maintain your desired asset allocation and minimize risk.

Importance of Monitoring Investments Regularly

Regularly monitoring your investments allows you to stay informed about the performance of your portfolio and make informed decisions. By tracking the performance of your stocks, you can identify any underperforming assets and take appropriate action to mitigate losses.

Tools and Resources for Tracking Portfolio Performance

- Online Brokerage Platforms: Many online brokerage platforms offer tools and resources to help you track your portfolio’s performance, analyze your investments, and set alerts for price changes.

- Financial News and Market Updates: Staying informed about financial news and market updates can help you make informed decisions about your investments and stay ahead of market trends.

- Portfolio Tracking Apps: There are various portfolio tracking apps available that allow you to monitor your investments on the go, set alerts, and access real-time market data.

In conclusion, Stock market investment for beginners equips you with the knowledge needed to navigate the complexities of the stock market with confidence. By following the strategies Artikeld here, you can embark on your investment journey with a clear understanding of how to make informed decisions and build a successful portfolio.

When it comes to investing, many people turn to actively managed mutual funds. These funds are managed by a team of professionals who make decisions on buying and selling investments based on research and analysis. If you’re looking for some top options in this category, check out this list of top actively managed mutual funds that have been performing well in the market.

When it comes to investing, many people turn to actively managed mutual funds for potential growth and returns. These funds are managed by professional money managers who make decisions on buying and selling investments within the fund. If you’re looking for some top options in this category, consider exploring the Top actively managed mutual funds list to see which ones might align with your investment goals and risk tolerance.