Investment options with the highest ROI opens the door to lucrative opportunities in the financial world. Explore the strategies and trends that can lead to significant returns on your investments.

Delve into the various factors influencing ROI and discover the emerging trends shaping the landscape of high-return investments.

Types of Investment Options

Investing is a great way to grow your wealth over time. There are various investment options available in the market, each with its own risk and return profile. Let’s explore some of the high ROI investment options and the associated risks.

Stocks

Stocks are shares of ownership in a company. Investing in stocks can offer high returns, but it also comes with high volatility and risk. Stock prices can fluctuate based on company performance, market conditions, and other factors.

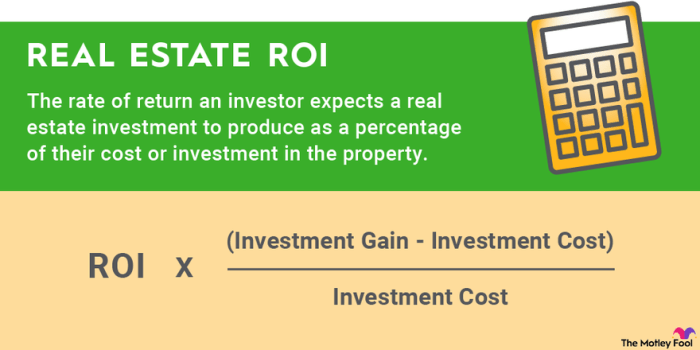

Real Estate

Real estate investing involves buying and owning properties to generate rental income or capital appreciation. Real estate can provide a steady income stream and potential for long-term growth. However, it also requires significant capital upfront and comes with risks such as property market fluctuations and maintenance costs.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Mutual funds offer professional management and diversification, reducing individual risk. However, they also come with management fees and market risk.

Bonds

Bonds are debt securities issued by governments or corporations to raise capital. Investing in bonds can provide a steady income stream through interest payments. Bonds are generally considered lower risk compared to stocks, but they also offer lower returns.

Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Investing in cryptocurrency can offer high returns, but it is highly volatile and speculative. Cryptocurrency investments are subject to regulatory risks and technological challenges.

Gold

Gold is a traditional safe-haven asset that investors turn to during times of economic uncertainty. Investing in gold can provide a hedge against inflation and currency devaluation. However, gold prices can fluctuate based on market conditions and geopolitical events.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual lenders. Investing in peer-to-peer lending can offer attractive returns compared to traditional savings accounts. However, it also comes with the risk of borrower default and lack of liquidity.

Investors should carefully consider their risk tolerance, investment goals, and time horizon before choosing an investment option. Diversification across different asset classes can help mitigate risk and maximize returns over the long term.

Factors Influencing ROI

When it comes to maximizing return on investment (ROI), there are several key factors that play a crucial role in determining the overall profitability of an investment. Understanding these factors is essential for making informed decisions and optimizing investment strategies.

Economic Conditions Impact

The state of the economy has a significant impact on ROI. During periods of economic growth, investments tend to perform well as businesses thrive and consumer spending increases. On the other hand, during economic downturns, investments may experience lower returns or even losses. Factors such as inflation rates, interest rates, and overall market stability can all influence the profitability of investments.

- High inflation rates can erode the real value of returns, reducing overall ROI.

- Low interest rates can make it challenging to find high-yield investment opportunities.

- Market volatility can lead to fluctuations in asset prices, affecting the performance of investments.

Role of Diversification

Diversification plays a crucial role in maximizing ROI by spreading investment across different asset classes, industries, and geographic regions. By diversifying a portfolio, investors can reduce risk and minimize the impact of market fluctuations on overall returns.

Diversification is a key strategy to protect against potential losses and optimize returns by investing in a mix of assets with varying risk levels.

- Investing in a mix of stocks, bonds, real estate, and other assets can help balance risk and return.

- Geographic diversification can protect against regional economic downturns and political instability.

- Diversifying across industries can reduce the impact of sector-specific risks on investment performance.

Emerging Trends in High ROI Investments

In today’s dynamic investment landscape, there are several emerging trends that offer the potential for high returns on investment. One of the key areas driving this trend is the rapid advancements in technology, particularly in industries such as blockchain and green energy.

Blockchain Technology

Blockchain technology, which forms the backbone of cryptocurrencies like Bitcoin, has been gaining significant traction in recent years. Its decentralized and secure nature has the potential to revolutionize various sectors, including finance, supply chain, and healthcare. Investments in blockchain-based projects and companies have shown promising returns, making it a lucrative option for investors looking for high ROI opportunities.

Green Energy Sector

The shift towards sustainable and renewable energy sources has created a lucrative investment opportunity in the green energy sector. With increasing global focus on environmental sustainability, companies involved in solar, wind, and other renewable energy technologies are poised for substantial growth. Investing in green energy projects not only offers the potential for high returns but also contributes to a more sustainable future.

Biotech and Healthcare Innovations, Investment options with the highest ROI

The biotechnology and healthcare industries are witnessing rapid advancements in areas such as precision medicine, gene editing, and telemedicine. Investing in companies at the forefront of these innovations can yield significant returns as these technologies have the potential to transform healthcare delivery and improve patient outcomes. The demand for innovative healthcare solutions continues to grow, making it a promising sector for high ROI investments.

E-commerce and Digital Platforms

The rise of e-commerce and digital platforms has opened up new avenues for investment with high ROI potential. Companies leveraging technology to enhance customer experience, streamline operations, and drive growth are attracting investor interest. As more consumers shift towards online shopping and digital services, investing in e-commerce and digital platforms can offer lucrative returns.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are reshaping industries across sectors such as finance, healthcare, and manufacturing. Investments in AI-driven technologies have the potential to drive efficiency, innovation, and competitive advantage for businesses. As AI continues to evolve and disrupt traditional business models, investing in AI and machine learning projects can lead to high returns on investment.

Strategies for Maximizing ROI: Investment Options With The Highest ROI

Investors can employ various strategies to optimize returns on their investments. One key approach is to diversify their investment portfolio across different asset classes to spread risk and maximize potential returns. By spreading investments across stocks, bonds, real estate, and other assets, investors can mitigate the impact of market fluctuations on their overall returns.

Importance of Long-Term Planning

Long-term planning is essential for maximizing ROI as it allows investors to take advantage of compounding returns. By staying invested over a longer period, investors can benefit from the power of compounding, where returns are reinvested to generate additional earnings. This long-term approach helps investors ride out short-term market volatility and achieve higher overall returns.

Comparison of Investment Strategies

- Value Investing: Value investing involves identifying undervalued stocks that have the potential for long-term growth. By purchasing these stocks at a discount to their intrinsic value, investors can potentially earn significant returns when the market recognizes the true worth of the company.

- Growth Investing: Growth investors focus on companies with strong growth prospects, even if they are trading at a premium. These investors are willing to pay a higher price for stocks of companies that are expected to grow rapidly in the future, with the expectation of earning substantial returns.

- Income Investing: Income investors prioritize generating a steady stream of income from their investments, often through dividends or interest payments. This strategy is popular among retirees or investors looking for a regular source of income.

In conclusion, navigating the world of investments requires a deep understanding of the options available and the strategies to maximize ROI. Stay informed, stay diversified, and watch your investments grow.

When it comes to real estate investment, beginners often find themselves overwhelmed with choices and decisions. However, with the right guidance and knowledge, navigating this complex market can be easier than expected. One of the key real estate investment tips for beginners is to start small and focus on learning the basics first. By understanding the fundamentals of real estate investment, such as market trends and property valuation, beginners can build a solid foundation for future success.

When it comes to real estate investment, beginners often feel overwhelmed by the complexities of the market. However, with the right guidance and knowledge, anyone can succeed in this field. To help you get started, here are some valuable real estate investment tips for beginners. From understanding market trends to conducting thorough research, these tips will set you on the path to financial success.