High-risk, high-reward investment options are a thrilling yet risky venture for investors looking to maximize returns. Dive into the world of these intriguing opportunities with us as we uncover the potential benefits and pitfalls awaiting those bold enough to take the plunge.

From deciphering the intricate balance between risk and reward to delving into the various types of investments available, this guide will equip you with the knowledge needed to navigate this volatile terrain with confidence.

Understanding High-Risk, High-Reward Investments: High-risk, High-reward Investment Options

High-risk, high-reward investment options are financial opportunities that come with a significant level of risk but also offer the potential for substantial returns. Investors who are willing to take on higher levels of risk in exchange for the possibility of greater profits often turn to these types of investments.

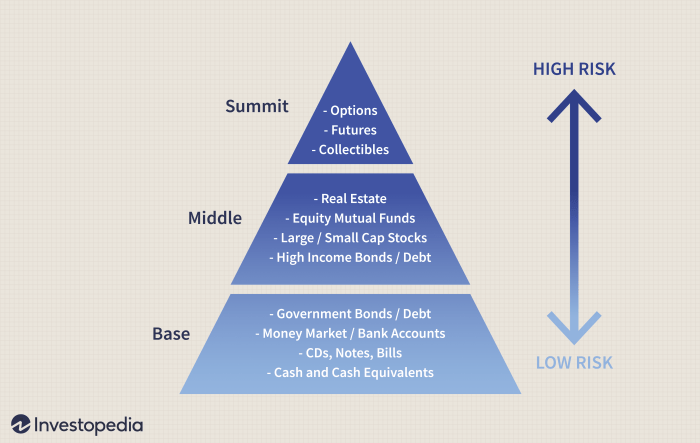

When it comes to high-risk, high-reward investments, the concept of risk versus reward plays a crucial role. Risk refers to the uncertainty or potential for loss associated with an investment, while reward relates to the potential gains or returns that can be achieved. In general, the higher the risk of an investment, the greater the potential reward, but also the higher the chance of incurring losses.

Examples of assets or strategies that fall under the high-risk, high-reward category include investing in volatile stocks, options trading, investing in emerging markets, venture capital investments, and cryptocurrency trading. These investments have the potential for significant gains, but they also come with a high level of risk due to factors such as market volatility, regulatory changes, and economic uncertainties.

Characteristics of High-Risk, High-Reward Investments

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png?w=700)

High-risk, high-reward investments are known for their potential to deliver substantial returns but come with a significant level of risk. These investment options typically exhibit certain characteristics that set them apart from more conservative choices.

Potential Returns and Losses, High-risk, high-reward investment options

High-risk, high-reward investments offer the opportunity for investors to earn significant profits in a relatively short period. However, the flip side of this potential high return is the equally high risk of losing a substantial portion, or even the entirety, of the invested capital. This risk-return trade-off is a defining feature of these investments.

Volatility and Unpredictability

Another key characteristic of high-risk, high-reward investments is their volatility and unpredictability. These investments are often subject to sudden and extreme price fluctuations, influenced by various factors such as market trends, economic conditions, and geopolitical events. As a result, investors must be prepared for the possibility of rapid and unexpected changes in the value of their investment.

Types of High-Risk, High-Reward Investment Options

High-risk, high-reward investment options come in various forms, each offering the potential for substantial returns but also carrying significant risks. These options are known for their volatility and the uncertainty surrounding their outcomes. Let’s explore some of the common types of high-risk, high-reward investments and compare them with traditional low-risk options.

Venture Capital

Venture capital investments involve funding early-stage startups or companies with high growth potential. While these investments offer the possibility of enormous returns if the startup succeeds, they also come with a high risk of failure. Compared to traditional stocks or bonds, venture capital investments have a much higher risk profile.

Cryptocurrencies

Investing in cryptocurrencies such as Bitcoin or Ethereum is another high-risk, high-reward option. The prices of digital currencies can be extremely volatile, leading to significant gains or losses in a short period. Unlike traditional currencies, cryptocurrencies are decentralized and not backed by any government, making them a risky investment choice.

Commodities Trading

Trading commodities like gold, oil, or agricultural products can be a high-risk, high-reward investment strategy. The prices of commodities are influenced by various factors such as supply and demand, geopolitical events, and economic indicators, leading to significant price fluctuations. While commodities can offer substantial returns, they also carry a high level of risk compared to more stable investments like index funds.

Real Estate Development

Investing in real estate development projects can also be considered a high-risk, high-reward option. Development projects require substantial capital investment and involve various risks such as market fluctuations, regulatory changes, and construction delays. However, successful real estate developments can yield significant profits for investors, making it an attractive but risky investment choice.

Emerging Markets Stocks

Investing in stocks from emerging markets such as Brazil, India, or China can be a high-risk, high-reward strategy. These markets are known for their volatility and susceptibility to economic and political instability. While investing in emerging markets stocks can offer the potential for high returns, it also comes with a higher level of risk compared to investing in established markets.

Risk Management Strategies for High-Risk, High-Reward Investments

Investing in high-risk, high-reward options can be lucrative, but it also comes with significant risks. To minimize these risks and maximize potential returns, investors need to implement effective risk management strategies.

Diversification Techniques

Diversification is key when dealing with high-risk investments. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of a single investment’s poor performance on your overall portfolio. This way, if one investment underperforms, the gains from other investments can help offset the losses.

Thorough Research Before Commitment

Before diving into high-risk, high-reward investments, it is crucial to conduct thorough research. This includes analyzing the financial health of the companies or assets you are investing in, understanding market trends, and assessing the potential risks involved. By arming yourself with relevant information, you can make more informed investment decisions and minimize the chances of unexpected setbacks.

In conclusion, high-risk, high-reward investment options present a tantalizing prospect for those seeking lucrative returns. However, it’s crucial to approach these opportunities with caution and a well-thought-out strategy to mitigate potential losses. By understanding the nuances of these investments and implementing effective risk management techniques, investors can harness the power of high risk for potentially high rewards in their investment journey.

When it comes to choosing the right mutual fund for you, it’s essential to consider your investment goals and risk tolerance. Sustainable investments are gaining popularity, especially for those looking towards 2024. If you’re interested in learning more about how to select the best mutual fund for sustainable investments in the upcoming year, check out this informative guide on How to choose the right mutual fund for youSustainable investments for 2024.

When it comes to choosing the right mutual fund for your investment portfolio, it’s crucial to consider your financial goals and risk tolerance. Sustainable investments for 2024 are gaining popularity, offering a way to align your values with your investments. Learn more about how to choose the right mutual fund for you and explore sustainable investment options for the future here.