Top high ROI stocks – Embark on a journey into the world of high ROI stocks with a focus on investment strategies, successful case studies, and market volatility. Discover the key to maximizing returns and minimizing risks in your investment portfolio.

Researching Top High ROI Stocks

When looking to invest in high ROI stocks, it is essential to conduct thorough research to identify the best opportunities. By analyzing key indicators and utilizing the right tools, investors can make informed decisions that maximize their returns.

Identifying High ROI Stocks

- Focus on companies with a history of consistent growth in revenue and earnings.

- Look for companies operating in sectors poised for future growth, such as technology or healthcare.

- Consider companies with a competitive advantage or unique value proposition in the market.

Tools and Resources for Research

- Financial websites like Yahoo Finance, Bloomberg, and CNBC provide valuable information and analysis on stocks.

- Stock screening tools like Finviz or Seeking Alpha help investors filter stocks based on specific criteria.

- Analyst reports and recommendations from reputable sources can offer insights into the potential of certain stocks.

Key Indicators to Look For

- Earnings Growth: Companies with a track record of increasing earnings are more likely to deliver high ROI.

- Price-to-Earnings Ratio (P/E): A low P/E ratio relative to industry peers may indicate an undervalued stock.

- Return on Investment (ROI): Analyzing the historical ROI of a company can help predict future returns.

- Debt Levels: Companies with manageable debt levels are generally more stable and have a higher potential for ROI.

Strategies for Investing in Top High ROI Stocks

When it comes to investing in high ROI stocks, having a solid strategy is crucial to maximize returns while minimizing risks. Let’s explore some key strategies to consider:

Comparing Different Investment Strategies

- Value Investing: This strategy involves identifying undervalued stocks with strong fundamentals and holding them for the long term.

- Growth Investing: Focuses on companies with high growth potential, even if they may be trading at a premium.

- Momentum Investing: Involves buying stocks that have shown upward momentum in the past and riding the trend.

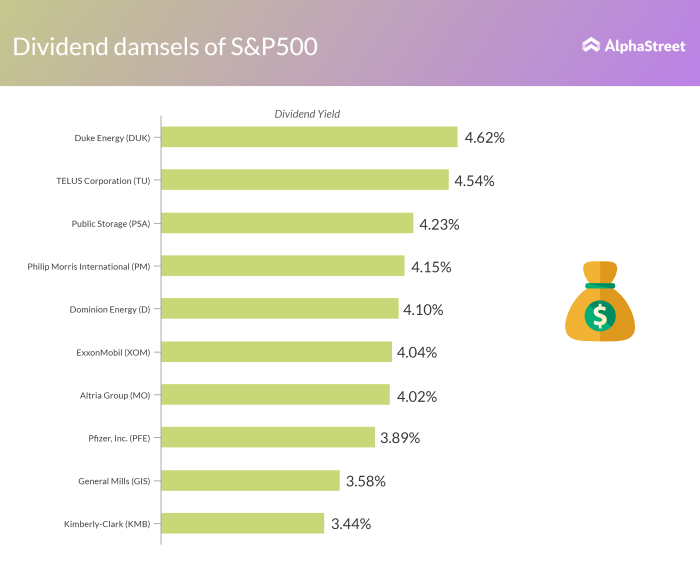

- Dividend Investing: Investing in stocks that pay regular dividends can provide a steady income stream while also offering potential for capital appreciation.

Tips for Mitigating Risks

- Do thorough research before investing in any stock to understand the company’s financial health and growth prospects.

- Diversify your portfolio across different sectors and industries to reduce the impact of market volatility on your investments.

- Set stop-loss orders to limit potential losses and protect your capital in case the stock price drops significantly.

- Avoid investing based on emotions or market hype, and stick to your investment plan.

Importance of Diversification

Diversification is a key strategy to reduce risk in a high ROI stock portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can minimize the impact of a downturn in any single investment. This helps to protect your portfolio from significant losses and maintain a more stable return over the long term.

Case Studies of Successful High ROI Stock Investments

Successful high ROI stock investments are the result of careful analysis, strategic decision-making, and a bit of luck. In this section, we will explore some case studies of companies that have delivered exceptional returns to their investors and examine the key factors that contributed to their success.

Apple Inc.

Apple Inc. is a prime example of a company that has consistently delivered high ROI to its investors. The success of Apple can be attributed to its innovative product lineup, strong brand loyalty, and strategic acquisitions. The introduction of game-changing products like the iPhone, iPad, and Apple Watch revolutionized the tech industry and propelled the company’s stock price to new heights. Additionally, Apple’s focus on customer experience and ecosystem integration has enabled it to maintain a competitive edge in the market.

Amazon.com, Inc.

Amazon.com, Inc. is another company that has generated impressive returns for its investors. The e-commerce giant’s relentless focus on customer satisfaction, relentless innovation, and strategic expansion into new markets have driven its stock price to unprecedented levels. Amazon’s cloud computing division, Amazon Web Services (AWS), has also played a significant role in boosting the company’s profitability and overall ROI. By diversifying its revenue streams and investing in emerging technologies, Amazon has cemented its position as a top performer in the stock market.

Tesla, Inc., Top high ROI stocks

Tesla, Inc. stands out as a standout example of a company that has defied traditional market norms and delivered exceptional ROI to its investors. The electric vehicle maker’s visionary CEO, Elon Musk, and groundbreaking technology have captured the imagination of investors worldwide. Tesla’s focus on sustainability, innovation, and disruptive business models has propelled its stock price to astronomical levels, making it one of the most valuable companies in the world. Despite facing challenges and controversies, Tesla’s commitment to pushing the boundaries of technology and sustainability has paid off handsomely for its investors.

Understanding Market Volatility and High ROI Stocks

Market volatility can have a significant impact on high ROI stocks, as these stocks tend to be more sensitive to changes in the market. Understanding how market volatility affects high ROI stocks is crucial for investors looking to maximize their returns while minimizing risks.

Impact of Market Volatility on High ROI Stocks

Market volatility can lead to fluctuations in the prices of high ROI stocks, causing rapid changes in value. This can create opportunities for investors to capitalize on short-term price movements, but it also comes with increased risk. High ROI stocks are often more volatile than other types of investments, making them subject to larger price swings in response to market conditions.

- Investors may experience higher levels of uncertainty and anxiety when market volatility increases, leading to emotional decision-making that can negatively impact investment outcomes.

- On the other hand, market volatility can also create buying opportunities for savvy investors who are willing to take on more risk in exchange for the potential for higher returns.

- It is important for investors to have a clear understanding of their risk tolerance and investment goals when navigating market volatility in the context of high ROI stocks.

Strategies for Navigating Market Volatility with High ROI Stocks

Navigating market volatility when investing in high ROI stocks requires a disciplined approach and a solid understanding of market dynamics. Here are some strategies to consider:

- Diversification: Spread your investments across different asset classes to reduce the impact of market volatility on your overall portfolio.

- Long-term perspective: Focus on the fundamentals of the companies you are investing in and adopt a long-term investment horizon to ride out short-term market fluctuations.

- Stress-testing: Evaluate the resilience of your portfolio to withstand different levels of market volatility and adjust your holdings accordingly.

Relationship Between Market Conditions and High ROI Stocks

The performance of high ROI stocks is closely tied to market conditions, as these stocks are often influenced by broader economic trends and industry-specific factors. Understanding the relationship between market conditions and high ROI stocks can help investors make informed decisions about their investment strategies.

Market conditions such as interest rates, inflation, and geopolitical events can impact the performance of high ROI stocks, leading to both opportunities and risks for investors.

Investors should stay informed about macroeconomic trends and industry developments to assess the potential impact on high ROI stocks in their portfolio.

Explore the dynamic landscape of high ROI stocks and gain valuable insights into crafting a successful investment strategy. With the right knowledge and approach, you can navigate market volatility and capitalize on lucrative opportunities in the stock market.

Investors looking for tax-efficient mutual funds should consider various factors such as the fund’s turnover ratio, tax efficiency, and distribution yield. By choosing tax-efficient mutual funds for investors , individuals can minimize their tax liabilities while maximizing their investment returns. These funds are designed to minimize capital gains distributions and provide long-term growth potential, making them an attractive option for tax-conscious investors.

When it comes to investing, tax-efficient mutual funds are a popular choice among investors looking to maximize their returns. These funds are designed to minimize the tax impact on your investments, allowing you to keep more of your hard-earned money. By investing in tax-efficient mutual funds for investors , you can benefit from potential tax savings while still enjoying the growth potential of the market.