Kicking off with Alternative investment options for 2024, this opening paragraph is designed to captivate and engage the readers, setting the tone semrush author style that unfolds with each word.

As we delve into the realm of alternative investments for 2024, we explore unconventional choices that can potentially enhance your investment portfolio. From cryptocurrencies to venture capital, the options are diverse and intriguing.

Types of alternative investments

In addition to traditional investments like stocks and bonds, alternative investments offer unique opportunities for diversification and potentially higher returns. Let’s explore some of the different types of alternative investments available for 2024.

Cryptocurrencies

Cryptocurrencies have gained popularity in recent years as a digital asset class. Examples include Bitcoin, Ethereum, and other altcoins. These investments are decentralized and offer potential for significant returns, but also come with higher volatility and regulatory risks.

Peer-to-peer lending, Alternative investment options for 2024

Peer-to-peer lending platforms allow individuals to lend money directly to borrowers, cutting out traditional financial institutions. This alternative investment option can provide passive income through interest payments, but carries the risk of borrower default.

Venture capital

Venture capital involves investing in early-stage startups with high growth potential. While this alternative investment can yield substantial returns if the startup succeeds, it also comes with a high risk of failure. Investors in venture capital funds typically have a longer investment horizon.

By comparing and contrasting traditional investments with alternative options like cryptocurrencies, peer-to-peer lending, and venture capital, investors can build a diversified portfolio that aligns with their risk tolerance and investment goals.

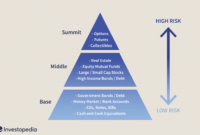

Risks and benefits of alternative investments

Alternative investments offer a unique set of risks and benefits that differ from traditional options, making them an attractive choice for investors looking to diversify their portfolios and potentially achieve higher returns.

When it comes to risks, alternative investments can be illiquid, meaning they are not easily converted to cash. This lack of liquidity can make it challenging to access funds quickly in times of need. Additionally, alternative investments often have higher fees compared to traditional assets, which can eat into potential returns. Another risk is the lack of regulation and oversight in some alternative investment markets, leaving investors vulnerable to fraud or manipulation.

On the other hand, alternative investments come with several benefits. One of the key advantages is the potential for higher returns compared to traditional investments like stocks and bonds. By including alternative assets in a portfolio, investors can diversify their holdings and reduce overall risk. Alternative investments also have the potential to provide a hedge against inflation, as their value may not be directly tied to the stock market or interest rates. In times of economic downturns, alternative investments can offer protection against market volatility and provide stability to a portfolio.

Diversification and reduced correlation

Alternative investments can help diversify a portfolio by adding assets that have low correlation with traditional investments. This can help spread risk and potentially improve overall returns. Real assets like real estate and commodities, as well as private equity and hedge funds, can provide this diversification benefit.

Potential for higher returns

One of the main attractions of alternative investments is the potential for higher returns compared to traditional options. Investments in private equity, venture capital, and certain hedge funds can offer opportunities for significant growth that may not be available in the public markets.

Hedging against inflation and economic downturns

Alternative investments, such as real assets like real estate and infrastructure, can act as a hedge against inflation. These assets tend to increase in value over time, keeping pace with or outperforming inflation rates. Additionally, during economic downturns, alternative investments can provide stability and protection against market volatility, helping to preserve wealth during challenging times.

Factors to consider before investing: Alternative Investment Options For 2024

When choosing alternative investment options, there are several key factors to consider to ensure a successful investment strategy. Factors such as liquidity, risk tolerance, investment horizon, and regulatory considerations play a crucial role in determining the suitability of alternative investments for individual investors.

Liquidity

Liquidity refers to how quickly an investment can be bought or sold in the market without significantly affecting its price. Alternative investments like real estate, private equity, and hedge funds are often less liquid compared to traditional investments like stocks and bonds. Before investing in alternative options, individuals should assess their need for liquidity and consider how easily they can access their funds if needed.

Risk Tolerance

Understanding your risk tolerance is essential when exploring alternative investments. These investments typically carry higher levels of risk compared to traditional assets, and individuals must be comfortable with the potential fluctuations in value. Before investing, it is important to assess your risk tolerance and determine how much volatility you can withstand in your portfolio.

Investment Horizon

The investment horizon refers to the length of time an investor plans to hold an investment before selling it. Alternative investments often have longer investment horizons compared to traditional assets. Individuals should consider their financial goals and time horizon when choosing alternative options to ensure they align with their investment objectives.

Regulatory Considerations

Regulatory considerations are crucial when investing in alternative options. Different types of alternative investments may be subject to varying levels of regulation, depending on the jurisdiction and investment structure. Before investing, individuals should understand the regulatory environment surrounding the alternative investment they are considering and ensure compliance with relevant laws and regulations.

Checklist for Individuals Exploring Alternative Investments in 2024

- Assess your need for liquidity and determine how easily you can access your funds.

- Evaluate your risk tolerance and ensure you are comfortable with the potential volatility of alternative investments.

- Consider your investment horizon and align it with your financial goals.

- Understand the regulatory environment surrounding the alternative investment options you are considering.

Emerging trends in alternative investments

In the ever-evolving landscape of alternative investments, several emerging trends are shaping the way investors approach this asset class. From ESG investing to the rise of impact investing and the growing interest in real assets like art and collectibles, there are several key trends to watch in 2024.

ESG Investing

ESG (Environmental, Social, and Governance) investing has gained significant traction in recent years as investors increasingly prioritize sustainability and ethical practices. Companies that demonstrate strong ESG principles are seen as more resilient and better positioned for long-term success. This trend is expected to continue growing as investors seek to align their portfolios with their values.

Impact Investing

Impact investing focuses on generating a positive social or environmental impact alongside financial returns. This approach allows investors to support causes they care about while also earning a profit. Impact investing has become more mainstream as investors look for ways to make a difference through their investment choices.

Real Assets like Art and Collectibles

Real assets such as art, collectibles, and other tangible assets have become increasingly popular among investors looking to diversify their portfolios. These assets have the potential to provide unique returns and serve as a hedge against market volatility. The growing interest in real assets reflects a broader shift towards alternative investments that offer both financial and aesthetic value.

Technological Advancements in Alternative Investments

Technological advancements are playing a significant role in shaping alternative investment opportunities. From blockchain technology enabling more transparent and secure transactions to artificial intelligence and machine learning improving investment decision-making, technology is revolutionizing the way investors engage with alternative assets. These advancements are expected to continue driving innovation and opening up new opportunities in the alternative investment space.

In conclusion, Alternative investment options for 2024 offer a unique way to diversify your investments and potentially boost returns. By carefully considering the risks, benefits, and emerging trends, investors can navigate the landscape of alternative investments with confidence.

When it comes to futuristic vehicles, the Cybertruck from Tesla stands out with its bold design and innovative features. This all-electric pickup truck has generated a lot of buzz since its unveiling, with its unique stainless steel exoskeleton and impressive performance capabilities. Whether you’re a fan of electric vehicles or simply intrigued by cutting-edge technology, the Cybertruck is definitely worth keeping an eye on.

When it comes to futuristic vehicles, the Cybertruck by Tesla is definitely a game-changer. With its unique design and advanced technology, this electric pickup truck has captured the attention of the automotive world. The Cybertruck’s stainless steel body and impressive performance make it a standout in the market. Whether you’re a fan of electric vehicles or simply appreciate innovation, the Cybertruck is a must-see.