Kicking off with Best bonds with high ROI, this opening paragraph is designed to captivate and engage the readers, setting the tone for what’s to come. In the world of investments, finding the best bonds with high return on investment (ROI) is a key goal for many investors. Whether it’s government bonds, corporate bonds, or municipal bonds, understanding the types of bonds that can offer high ROI is crucial. Dive into this comprehensive guide to learn about the factors influencing bond ROI, strategies for maximizing returns, and the risks associated with high ROI bonds. Get ready to elevate your investment portfolio with the best bonds for high ROI.

Types of bonds for high ROI: Best Bonds With High ROI

Government bonds, corporate bonds, and municipal bonds are all popular options for investors looking for high returns on their investments. Each type of bond has its own unique characteristics and potential risks and rewards.

Government Bonds

Government bonds are considered one of the safest investments as they are backed by the government’s ability to tax its citizens. While government bonds typically offer lower returns compared to corporate bonds, they are generally considered more stable and less risky. Examples of government bonds include U.S. Treasury bonds and municipal bonds.

Corporate Bonds

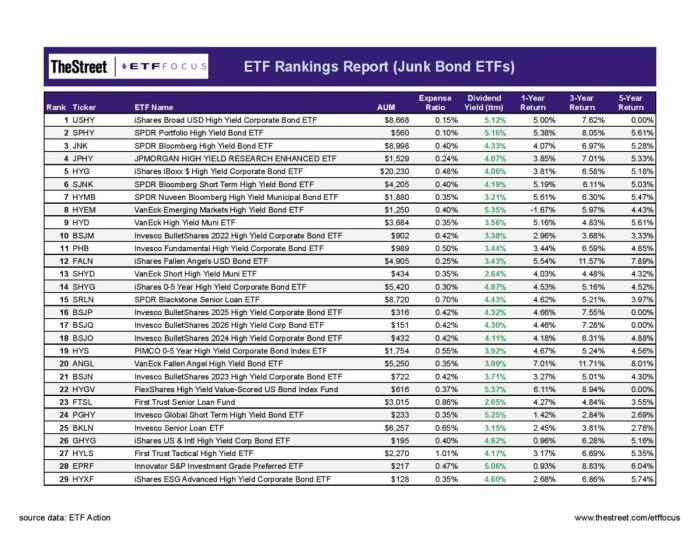

Corporate bonds are issued by corporations to raise capital for various purposes. These bonds typically offer higher returns compared to government bonds but come with higher risk due to the creditworthiness of the issuing corporation. High-yield corporate bonds, also known as junk bonds, offer even higher returns but are considered riskier investments due to the higher probability of default. Examples of corporate bonds include bonds issued by companies like Apple or Microsoft.

Municipal Bonds

Municipal bonds are issued by state and local governments to fund public projects such as schools, roads, and utilities. These bonds offer tax advantages for investors, making them an attractive option for those in higher tax brackets. While municipal bonds generally offer lower returns compared to corporate bonds, they are considered relatively safe investments. Examples of municipal bonds include bonds issued by cities like New York or Los Angeles.

Investors should carefully consider their risk tolerance and investment goals when choosing between government, corporate, and municipal bonds for high ROI opportunities.

Factors influencing bond ROI

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5HNTTQZIMZENNJNXUTJUVECXC4.png?w=700)

Interest rates have a significant impact on bond prices and returns. When interest rates rise, existing bond prices tend to decrease as new bonds with higher rates become more attractive. This can lead to a decrease in the ROI of existing bonds. On the other hand, when interest rates fall, bond prices tend to increase, resulting in higher returns for bondholders.

Role of credit ratings in determining the ROI of a bond

Credit ratings play a crucial role in determining the ROI of a bond. Bonds with higher credit ratings are considered less risky and therefore tend to offer lower returns. On the other hand, bonds with lower credit ratings are perceived as riskier investments and typically offer higher returns to compensate for the increased risk. Investors need to consider the credit rating of a bond issuer when assessing the potential ROI of a bond.

Impact of macroeconomic factors on bond performance

Various macroeconomic factors such as inflation and economic growth can affect bond performance. Inflation erodes the purchasing power of fixed bond payments, leading to a decrease in real returns for bondholders. Economic growth can influence bond returns as well, with stronger economic conditions generally leading to higher returns on bonds. Investors should consider these macroeconomic factors when evaluating the potential ROI of bonds in their investment portfolio.

Strategies for maximizing bond ROI

When it comes to maximizing bond ROI, investors need to employ strategic approaches that can help enhance returns on their investments. Diversification, bond laddering, and thorough research are key strategies that can contribute to achieving high ROI in the bond market.

Diversifying a bond portfolio

Diversifying a bond portfolio involves spreading investments across different types of bonds, issuers, and maturities. By diversifying, investors can reduce the risk associated with any single bond or issuer, ultimately increasing the potential for higher returns. It is important to consider factors such as credit quality, interest rate sensitivity, and sector exposure when diversifying a bond portfolio.

Bond laddering

Bond laddering is a strategy where investors purchase bonds with staggered maturity dates. This approach helps mitigate the risk of interest rate fluctuations by spreading out bond maturities. By reinvesting the proceeds from maturing bonds into new bonds, investors can take advantage of higher interest rates while maintaining liquidity. Bond laddering can provide a consistent income stream and reduce the impact of interest rate changes on the overall portfolio.

Thorough research before investing

Conducting thorough research before investing in bonds is essential for optimizing returns. Investors should carefully analyze the creditworthiness of bond issuers, assess interest rate trends, and consider economic factors that may impact bond performance. By staying informed and conducting due diligence, investors can make well-informed decisions that align with their investment objectives and maximize bond ROI.

Risks associated with high ROI bonds

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7CDN2KTLNRHDXEYERM3RHNK5SE.png?w=700)

Investing in high-yield bonds comes with its own set of risks that investors need to carefully consider. While the potential for higher returns is attractive, it’s essential to be aware of the risks involved to make informed investment decisions.

Comparison of Risks, Best bonds with high ROI

When comparing the risks of high ROI bonds to other investment options such as stocks, one key difference lies in the level of volatility. High-yield bonds typically have a higher risk of default compared to investment-grade bonds, making them more similar to stocks in terms of risk. However, unlike stocks, bonds have a fixed maturity date, which can provide some level of predictability in returns.

- Default Risk: High-yield bonds are issued by companies with lower credit ratings, increasing the risk of default. Investors may not receive their principal and interest payments if the issuer defaults.

- Interest Rate Risk: High-yield bonds are more sensitive to changes in interest rates, leading to fluctuations in their market value. Rising interest rates can negatively impact bond prices.

- Liquidity Risk: High-yield bonds may have lower liquidity compared to investment-grade bonds, making it challenging to sell them quickly at fair prices, especially during market downturns.

Geopolitical Impact

Geopolitical events can significantly impact the ROI of bonds, especially high-yield bonds. For example, political instability, trade wars, or economic crises in a particular region can lead to increased default rates among bond issuers, affecting investors’ returns. It’s crucial for investors to stay informed about global events and their potential impact on bond markets to mitigate geopolitical risks.

In conclusion, Best bonds with high ROI are a lucrative investment option for those looking to maximize returns. By understanding the different types of bonds, factors influencing ROI, and effective strategies for boosting returns, investors can make informed decisions to grow their wealth. Remember to always conduct thorough research and stay informed about market trends to make the most of your bond investments. Start building a strong bond portfolio today and watch your ROI soar to new heights.

When it comes to venturing into the world of stock market, beginners often find themselves overwhelmed with the vast array of investment strategies available. However, understanding the basics is crucial. One of the key stock investment strategies for beginners is to focus on long-term growth rather than short-term gains. By diversifying your portfolio and conducting thorough research, you can minimize risks and maximize returns.

To learn more about stock investment strategies for beginners, check out this comprehensive guide: Stock investment strategies for beginners.

When it comes to stock investment strategies for beginners, it’s important to start with the basics. One key tip is to diversify your portfolio to minimize risk. Another strategy is to research and choose companies with strong fundamentals. Additionally, staying informed about market trends and seeking advice from financial experts can help you make informed decisions. To learn more about effective stock investment strategies for beginners, check out this comprehensive guide: Stock investment strategies for beginners.