With Best high ROI investments for 2024 at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

In the realm of investments, 2024 holds promises of lucrative opportunities for those seeking high returns. From real estate to stocks and cryptocurrencies, there are various avenues to explore for maximizing your ROI. Let’s delve into the top investment options that could potentially skyrocket your wealth in the coming year.

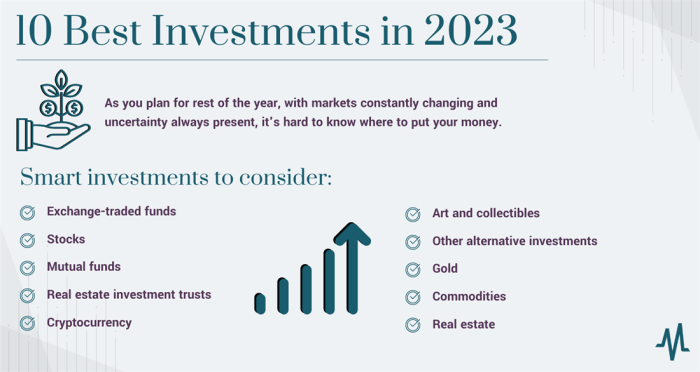

Types of High ROI Investments

When looking for high ROI investments in 2024, there are several types to consider. Each type has its own characteristics, benefits, and associated risks that investors need to be aware of.

Stock Market Investments

Investing in the stock market involves buying shares of publicly traded companies. The potential for high returns comes from the growth of these companies over time. However, stock market investments also come with volatility and the risk of losing money if the market takes a downturn.

Real Estate Investments

Real estate investments can offer high returns through rental income, property appreciation, and potential tax benefits. Investing in residential or commercial properties can provide a steady stream of income, but it also requires significant capital and comes with risks such as market fluctuations and property maintenance costs.

Cryptocurrency Investments

Cryptocurrencies have gained popularity as high ROI investments due to their potential for rapid price appreciation. However, the volatile nature of the crypto market also presents significant risks, including regulatory challenges and security concerns.

Peer-to-Peer Lending, Best high ROI investments for 2024

Peer-to-peer lending platforms allow investors to lend money to individuals or businesses in exchange for interest payments. This alternative investment option can provide high returns compared to traditional savings accounts, but it also carries the risk of defaults and borrower credibility issues.

Entrepreneurial Ventures

Investing in entrepreneurial ventures or startups can potentially yield high returns if the business becomes successful. However, this type of investment is highly risky, as many startups fail, and investors may lose their entire investment.

Commodities Investments

Investing in commodities like gold, silver, oil, or agricultural products can offer diversification and potential high returns. However, commodity prices are influenced by various factors like supply and demand, geopolitical events, and economic conditions, leading to price volatility and investment risks.

Angel Investing

Angel investing involves providing capital to early-stage startups in exchange for equity ownership. While successful angel investments can generate substantial returns, the failure rate of startups is high, making this type of investment risky.

Collectibles and Fine Art

Investing in collectibles, such as rare coins, stamps, or artwork, can provide high returns if the value of these items appreciates over time. However, the illiquidity of collectibles and the subjective nature of their valuation pose risks to investors.

Real Estate Investments

Investing in real estate can offer high ROI opportunities for 2024. The key to success lies in understanding the market, evaluating potential properties, and implementing effective investment strategies. Here are some key factors to consider when venturing into real estate investments:

Market Analysis

Before investing in real estate, conducting a thorough market analysis is crucial. This involves studying trends, demand-supply dynamics, and economic indicators in the target location. By identifying emerging markets or areas with growth potential, investors can capitalize on high ROI opportunities.

Property Selection

Choosing the right property is essential for maximizing returns. Factors to consider include location, property type, condition, and potential for appreciation. Whether investing in residential, commercial, or rental properties, selecting assets with strong growth prospects is key to achieving high ROI.

Financial Planning

Developing a sound financial plan is essential for real estate investments. This includes budgeting for acquisition costs, renovation expenses, ongoing maintenance, and potential vacancies. Investors should also consider financing options, loan terms, and tax implications to optimize their returns.

Rental Income Strategies

For investors targeting rental properties, implementing effective income strategies is critical. This may involve setting competitive rental rates, screening tenants rigorously, and maintaining positive cash flow. By maximizing rental income and minimizing expenses, investors can enhance their ROI over time.

Long-Term Appreciation

Real estate investments offer the potential for long-term appreciation, leading to substantial ROI. By investing in markets with strong growth potential, holding onto properties for extended periods, and leveraging market trends, investors can benefit from capital appreciation and wealth accumulation.

In conclusion, real estate investments can provide lucrative opportunities for investors seeking high ROI in 2024. By conducting thorough market research, selecting the right properties, developing a solid financial plan, implementing effective income strategies, and focusing on long-term appreciation, investors can maximize their returns and build wealth through real estate investments.

Stock Market Investments: Best High ROI Investments For 2024

When it comes to high ROI investments in the stock market for 2024, it is essential to consider various factors that can impact the potential returns on investment. Analyzing stocks for their potential ROI requires a combination of fundamental and technical analysis to identify companies with strong growth prospects and undervalued stocks.

Best High ROI Stocks for 2024

- Technology Sector: Companies in the technology sector often offer high ROI potential due to their innovative products and services. Consider investing in companies like Apple, Microsoft, or Amazon.

- Healthcare Sector: Healthcare companies with promising drugs or medical devices in the pipeline can provide substantial returns. Look into investing in companies like Pfizer, Johnson & Johnson, or Moderna.

- Renewable Energy Sector: With the increasing focus on sustainability, investing in renewable energy companies such as Tesla, NextEra Energy, or Enphase Energy can lead to high ROI.

Analyzing Stocks for Potential ROI

When analyzing stocks for their potential ROI, consider factors such as the company’s financial health, growth prospects, competitive position in the market, and macroeconomic trends that could impact the industry.

- Financial Health: Look at key financial metrics like revenue growth, profit margins, and debt levels to assess the company’s stability and growth potential.

- Growth Prospects: Evaluate the company’s product pipeline, market share, and expansion plans to determine its potential for future growth and profitability.

- Competitive Position: Analyze the company’s competitive advantages, market position, and ability to fend off competitors to gauge its long-term sustainability.

Long-term vs. Short-term Strategies for Stock Market Investments

- Long-term Investing: Long-term investing involves buying and holding stocks for an extended period, typically years, to benefit from compounding returns and ride out market volatility. This strategy is suitable for investors looking for stable growth and passive income.

- Short-term Trading: Short-term trading focuses on buying and selling stocks within a short time frame, often days or weeks, to capitalize on price movements and market trends. This strategy requires active monitoring and research to make quick decisions for profit.

Cryptocurrency Investments

Cryptocurrency investments have gained significant popularity in recent years due to their potential for high returns. As we look ahead to 2024, it is crucial to identify the top cryptocurrencies with the potential for high ROI, understand the technology or trends driving their growth, and weigh the risks and benefits associated with investing in this volatile asset class.

Top Cryptocurrencies with Potential High ROI in 2024

- Bitcoin (BTC): As the pioneer cryptocurrency, Bitcoin continues to be a favored investment option for many. Its scarcity and widespread adoption contribute to its potential for high ROI.

- Ethereum (ETH): Ethereum’s smart contract capabilities and upcoming upgrades, such as Ethereum 2.0, position it as a promising investment with potential for significant growth.

- Cardano (ADA): Known for its focus on sustainability and scalability, Cardano has been gaining traction among investors and developers, making it a cryptocurrency to watch for high ROI.

Technology and Trends Driving the Growth of Cryptocurrencies

The integration of blockchain technology, decentralized finance (DeFi) applications, and non-fungible tokens (NFTs) are key trends driving the growth of cryptocurrencies and expanding their use cases.

Risks and Benefits of Investing in Cryptocurrencies

- Risks:

- Volatility: Cryptocurrencies are highly volatile assets, which can lead to significant price fluctuations and potential losses.

- Regulatory Uncertainty: Regulatory changes or crackdowns on cryptocurrencies by governments can impact their value and legality.

- Cybersecurity Risks: The decentralized nature of cryptocurrencies makes them vulnerable to hacking and security breaches.

- Benefits:

- High ROI Potential: Cryptocurrencies have the potential for exponential returns, outperforming traditional asset classes.

- Diversification: Investing in cryptocurrencies can diversify your investment portfolio and hedge against economic uncertainties.

- 24/7 Market: Cryptocurrency markets operate 24/7, providing flexibility for trading and investment opportunities at any time.

As we wrap up our exploration of the best high ROI investments for 2024, it’s clear that strategic investment decisions can pave the way for financial success. By carefully analyzing the risks and rewards of different investment types, investors can position themselves for substantial gains. Whether it’s through real estate, stocks, or cryptocurrencies, the key lies in informed decision-making and a long-term vision. Seize the opportunities that 2024 presents and watch your investments flourish.

When diving into the world of investing, it’s crucial for beginners to understand the basics of stocks. A great starting point is the Beginner’s guide to investing in stocks , which provides valuable insights on how to get started, what to look for in a company, and how to build a diversified portfolio. By following this guide, novice investors can gain a solid foundation and make informed decisions when entering the stock market.

When it comes to diving into the world of investing in stocks, beginners may find themselves overwhelmed with information and choices. That’s why having a solid Beginner’s guide to investing in stocks can be incredibly helpful. This guide covers the basics of stock investing, how to get started, and essential tips for success. Whether you’re a complete novice or looking to brush up on your knowledge, this guide is a valuable resource to kickstart your investment journey.