Best ways to achieve high returns on investment sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with semrush author style and brimming with originality from the outset.

Understanding the importance of high returns and the different strategies involved opens up a world of possibilities for investors seeking to maximize their investments.

Understanding the Concept

Investing is a crucial aspect of finance that involves allocating resources with the expectation of generating profitable returns in the future. High returns on investment refer to achieving significant gains or profits compared to the initial investment amount.

For individuals, high returns on investment can lead to financial security, wealth accumulation, and the ability to meet long-term goals such as retirement or education funding. For businesses, high returns on investment are essential for growth, competitiveness, and sustainability in the market.

Significance of Achieving High Returns on Investment

- High returns on investment can provide a source of passive income, allowing individuals to build wealth over time.

- Businesses with high returns on investment can reinvest profits into expansion, innovation, and improving operations.

- High returns on investment signal successful financial management and strategic decision-making.

Basic Principles of Investing for High Returns

- Set clear investment goals and identify the risk tolerance level to determine suitable investment strategies.

- Diversify the investment portfolio to spread risk and maximize potential returns.

- Regularly monitor and review investments to make informed decisions based on market trends and performance.

- Consider long-term growth potential and avoid making impulsive investment decisions based on short-term market fluctuations.

Types of Investments

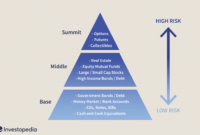

Investing is a crucial aspect of financial planning, and there are various types of investment options available to individuals looking to grow their wealth. These options range from high-risk, high-return investments to low-risk, low-return alternatives. It is important to understand the differences between these options and how they can impact your investment portfolio.

High-Risk, High-Return Investments vs. Low-Risk, Low-Return Options

When it comes to investing, the general rule is that higher returns come with higher risks. High-risk, high-return investments, such as stocks, cryptocurrencies, and venture capital, have the potential for significant gains but also carry a greater chance of loss. On the other hand, low-risk, low-return options, like bonds, savings accounts, and CDs, offer more stability but with lower potential returns.

- High-risk, high-return investments:

- Stocks: Investing in individual company stocks can provide substantial returns but also comes with volatility.

- Cryptocurrencies: Digital currencies like Bitcoin have seen explosive growth but are highly speculative.

- Venture capital: Investing in startups can yield high returns if successful but involves a high level of risk.

- Low-risk, low-return options:

- Bonds: Fixed-income securities issued by governments or corporations offer steady returns but lower potential for growth.

- Savings accounts: FDIC-insured accounts provide a safe place to store cash with minimal risk but offer minimal returns.

- Certificates of Deposit (CDs): Time deposits with fixed interest rates offer guaranteed returns but with limited growth potential.

Traditional and Alternative Investment Vehicles

In addition to stocks, bonds, and savings accounts, there are alternative investment vehicles that can offer high returns for investors willing to take on additional risk. These alternatives can provide diversification and potential for greater gains beyond traditional options.

- Real Estate Investment Trusts (REITs): Investing in real estate through REITs allows for passive income and potential appreciation in property values.

- Peer-to-Peer Lending: Platforms that connect borrowers with investors can generate high returns through interest payments.

- Commodities: Investing in physical goods like gold, silver, or oil can provide a hedge against inflation and market volatility.

Risk Management Strategies: Best Ways To Achieve High Returns On Investment

When it comes to investing, managing risk is crucial for achieving high returns on investment. By implementing effective risk management strategies, investors can protect their capital and enhance their overall portfolio performance. One key strategy for managing risk is diversification, which involves spreading investments across different asset classes to reduce exposure to any single investment. This can help mitigate risks and maximize returns by ensuring that losses in one area are offset by gains in another.

Diversification for Risk Mitigation

Diversification is a fundamental risk management strategy that involves allocating investments across various asset classes, industries, and geographic regions. By spreading investments in this way, investors can reduce the impact of any single investment underperforming or experiencing losses. This helps to mitigate risk and protect the overall portfolio from significant downturns.

- Diversifying across asset classes such as stocks, bonds, real estate, and commodities can help balance the risk exposure in a portfolio.

- Investing in different industries and sectors can also help diversify risk, as different sectors may perform differently under varying market conditions.

- Geographic diversification, by investing in both domestic and international markets, can further reduce risk by minimizing exposure to any single country’s economic or political events.

Balancing Risk and Return

While risk management is essential, it is also crucial to find the right balance between risk and return to optimize investment portfolios. Investors should consider their risk tolerance, investment goals, and time horizon when determining the appropriate level of risk in their portfolios.

It is important to strike a balance between taking on enough risk to achieve attractive returns and avoiding excessive risk that could jeopardize your investment goals.

- Asset allocation plays a key role in balancing risk and return, as different asset classes have varying levels of risk and return potential.

- Regularly reviewing and rebalancing your portfolio can help maintain the desired risk-return profile over time, ensuring that your investments align with your financial objectives.

- Utilizing risk management tools such as stop-loss orders, hedging strategies, and diversification techniques can further help investors optimize risk-adjusted returns.

Market Analysis and Timing

Market analysis plays a crucial role in identifying high-return investment opportunities. By analyzing various market factors such as trends, competition, and consumer behavior, investors can make informed decisions to maximize their returns. Timing is equally important, as capitalizing on market trends at the right moment can lead to significant profits. Here are some tips for conducting thorough market research and analysis to make informed investment decisions.

Importance of Market Research

Market research is essential for investors to understand the current landscape and identify potential opportunities. By analyzing market trends, consumer preferences, and competitive forces, investors can make strategic decisions that align with market conditions. Conducting thorough market research can help investors anticipate changes, mitigate risks, and capitalize on emerging trends.

- Utilize various sources of information such as financial reports, industry publications, and market data to gather insights.

- Consider macroeconomic factors like GDP growth, inflation rates, and interest rates to assess the overall market environment.

- Study competitor analysis to understand market dynamics and positioning relative to other players in the industry.

- Monitor consumer behavior and preferences to identify evolving trends and opportunities for investment.

By conducting comprehensive market research, investors can gain a competitive edge and make well-informed investment decisions.

Timing in Capitalizing on Market Trends, Best ways to achieve high returns on investment

Timing is crucial in the world of investing, as identifying and capitalizing on market trends at the right moment can lead to substantial returns. Investors need to stay vigilant and monitor market conditions to seize opportunities as they arise. Understanding the cyclical nature of markets and being able to predict potential shifts can help investors navigate volatile environments and make profitable decisions.

- Stay informed about market news and developments to identify potential investment opportunities.

- Use technical analysis tools and indicators to assess market trends and predict future price movements.

- Consider the impact of external events such as geopolitical changes or policy decisions on market dynamics.

- Be prepared to act swiftly when market conditions align with your investment strategy and risk tolerance.

Successful investors understand the importance of timing and are able to make decisions quickly and decisively to capitalize on market trends.

In conclusion, mastering the best ways to achieve high returns on investment is a crucial step towards financial success. By implementing effective strategies, managing risks, and staying informed about market trends, investors can pave the way for lucrative returns and long-term growth.

When looking for high-performance mutual funds for 2024, it’s essential to consider various factors such as the fund’s track record, management team, and fees. You can explore a list of top-performing mutual funds for the upcoming year on High-performance mutual funds for 2024 to make informed investment decisions. These funds have shown consistent growth and are managed by experienced professionals in the industry.

Investors looking for high-performance mutual funds for 2024 should consider diversifying their portfolio to maximize returns. Research shows that funds with a track record of consistent growth and low fees tend to outperform the market. By investing in high-performance mutual funds for 2024 , you can potentially achieve your financial goals faster and more efficiently.