Commercial real estate investment strategies involve a strategic approach to maximize returns and minimize risks. By exploring various types of investments, financing options, and risk management techniques, investors can make informed decisions to achieve their financial goals.

Commercial Real Estate Investment Strategies

Investing in commercial real estate can be a lucrative venture for those looking to diversify their portfolio and generate long-term wealth. It is essential to have a well-thought-out investment strategy in place to maximize returns and mitigate risks in this asset class.

Importance of Diversification in Commercial Real Estate Investments

Diversification is key when it comes to commercial real estate investments. By spreading your investments across different types of properties, locations, and asset classes, you can reduce the overall risk in your portfolio. This helps protect your investments from market fluctuations and economic downturns, ensuring a more stable and consistent return on investment.

- Investing in different types of commercial properties such as office buildings, retail spaces, industrial warehouses, and multifamily apartments can help spread risk and increase potential returns.

- Diversifying across different geographical locations can protect your investments from local market variations and economic conditions.

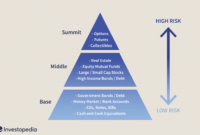

- Allocating funds to various asset classes like core, core-plus, value-add, and opportunistic properties can provide a balanced risk-reward profile in your investment portfolio.

Diversification is not only about spreading risk but also about maximizing returns by capitalizing on different market opportunities.

Key Factors to Consider When Developing a Commercial Real Estate Investment Strategy

When developing a commercial real estate investment strategy, it is crucial to consider several key factors to ensure success and profitability in your investments.

- Market Research: Conduct thorough market research to identify emerging trends, demand-supply dynamics, and growth opportunities in specific markets.

- Financial Analysis: Perform detailed financial analysis, including cash flow projections, ROI calculations, and risk assessments to evaluate the profitability of potential investments.

- Risk Management: Implement risk management strategies to mitigate potential risks, such as market volatility, tenant vacancies, and interest rate fluctuations.

- Exit Strategy: Develop a clear exit strategy outlining your investment goals, timeline, and potential exit options to optimize returns and liquidity.

Types of Commercial Real Estate Investments

Commercial real estate investments offer a variety of options for investors looking to diversify their portfolios and generate income. Different types of commercial real estate properties include office buildings, retail spaces, and industrial properties. Each type has its unique characteristics, risk profile, and potential returns.

Office Buildings

Office buildings are commercial properties primarily used for office space and professional services. These properties can range from small office buildings to high-rise towers in central business districts. Investing in office buildings can provide stable income streams through long-term leases with corporate tenants. However, vacancies and economic downturns can impact rental income and property values.

Retail Spaces, Commercial real estate investment strategies

Retail spaces include shopping centers, strip malls, and standalone retail buildings. These properties are leased to retailers and businesses that serve the public. Retail investments can offer higher returns compared to other commercial real estate types but are also subject to market trends, consumer behavior, and competition from e-commerce. Location and foot traffic are critical factors influencing the success of retail properties.

Industrial Properties

Industrial properties encompass warehouses, distribution centers, and manufacturing facilities. These properties are essential for logistics and supply chain operations. Investing in industrial properties can provide stable cash flow due to long-term leases with logistics companies and manufacturers. Factors like proximity to transportation hubs, infrastructure, and demand for industrial space in a region influence the performance of industrial properties.

Financing Strategies for Commercial Real Estate Investments: Commercial Real Estate Investment Strategies

When it comes to investing in commercial real estate, securing the right financing is crucial for success. There are various financing options available to investors, each with its own pros and cons. Understanding these options and knowing how to leverage them effectively can make a significant difference in the profitability of your commercial real estate investments.

Different Financing Options

- Traditional Bank Loans: These are the most common type of financing for commercial real estate investments. They typically offer lower interest rates and longer repayment terms, but they also come with strict eligibility requirements and lengthy approval processes.

- Commercial Mortgage-backed Securities (CMBS): These are bonds that are secured by commercial real estate loans. They provide access to large amounts of capital, but they can be complex and come with higher interest rates.

- Private Lenders: Private lenders offer more flexibility in terms of loan terms and eligibility requirements. They can be a good option for investors who may not qualify for traditional bank loans.

- Crowdfunding: This is a newer financing option that allows multiple investors to pool their resources together to fund a commercial real estate project. It provides access to capital from a diverse group of investors, but it can also be more complicated to manage.

Pros and Cons of Using Leverage

- Pros: Using leverage can amplify your returns on investment by allowing you to control a larger asset with a smaller initial investment. It can also help diversify your portfolio and increase your overall wealth.

- Cons: On the flip side, leverage also increases the risk in your investment. If the property does not perform as expected, you may find yourself in a difficult financial situation with debt to repay. It’s important to carefully consider the risks before leveraging your investments.

Tips on Securing Financing

- Improve Your Credit Score: A higher credit score can improve your chances of securing favorable financing terms and lower interest rates.

- Prepare a Solid Business Plan: Lenders will want to see a detailed business plan outlining your investment strategy, projected returns, and potential risks.

- Work with an Experienced Commercial Real Estate Broker: A knowledgeable broker can help you navigate the financing process and connect you with lenders who specialize in commercial real estate investments.

- Consider Multiple Financing Options: Don’t limit yourself to traditional bank loans. Explore different financing options to find the best fit for your investment goals.

Risk Management in Commercial Real Estate Investments

Investing in commercial real estate can offer lucrative returns, but it also comes with its fair share of risks. Effective risk management strategies are crucial to safeguard investments and maximize profitability. Let’s explore some key approaches to managing risks in commercial real estate investments.

Role of Due Diligence in Mitigating Risks

Due diligence plays a critical role in mitigating risks in commercial real estate investments. Thorough research and analysis of the property, market conditions, and potential risks are essential before making any investment decisions. This process helps investors identify and assess potential risks, such as environmental issues, zoning restrictions, or hidden liabilities, allowing them to make informed choices and mitigate these risks effectively.

- Conducting comprehensive property inspections and assessments to uncover any potential issues or defects

- Reviewing financial records, leases, and tenant agreements to identify any red flags or concerns

- Analyzing market trends and economic indicators to anticipate potential risks related to demand and supply dynamics

Proper due diligence is the foundation of successful commercial real estate investments, helping investors make informed decisions and mitigate potential risks effectively.

Examples of Unforeseen Risks and How to Address Them

Despite thorough due diligence, unforeseen risks can still arise in commercial real estate investments. It is essential for investors to be prepared to address these risks promptly and effectively to protect their investments.

- Natural Disasters: Unexpected events like hurricanes, earthquakes, or floods can damage properties and disrupt operations. Investors should consider purchasing adequate insurance coverage to mitigate the financial impact of such disasters.

- Economic Downturns: Market fluctuations and economic downturns can affect property values and rental income. Diversifying the investment portfolio and maintaining a healthy cash reserve can help buffer against the impact of economic uncertainties.

- Lawsuits and Legal Issues: Legal disputes with tenants, contractors, or regulatory authorities can pose significant risks to investments. Engaging legal professionals and ensuring compliance with all regulations can help mitigate legal risks effectively.

Being prepared for unforeseen risks and having contingency plans in place are essential elements of effective risk management in commercial real estate investments.

In conclusion, mastering commercial real estate investment strategies is essential for navigating the complexities of the real estate market. By understanding the key principles and factors discussed, investors can build a robust investment portfolio that stands the test of time.

Looking for the best investment opportunities for 2024? Check out this comprehensive guide on best investment opportunities for 2024 to stay ahead of the game and make informed decisions for your financial future.

Looking for the best investment opportunities for 2024? Look no further! Our comprehensive guide highlights the top sectors and industries poised for growth in the coming year. From technology to renewable energy, there are plenty of options to consider. Check out our article on the best investment opportunities for 2024 to make informed decisions and maximize your returns.