High-return investments for 2024 sets the stage for exploring lucrative investment opportunities that promise significant returns. Dive into a world of financial possibilities as we dissect the best strategies to secure your financial future.

Explore the various types of investments, analyze market trends, and learn essential risk management techniques to navigate the dynamic landscape of investing in 2024.

Types of High-return Investments

When considering high-return investments for 2024, it is essential to explore various options that offer the potential for significant gains. Let’s delve into the types of investments that could yield lucrative returns in the upcoming year.

Stocks

Investing in stocks has long been a popular choice for those seeking high returns. While stocks can offer substantial profits, they also come with a high level of risk due to market volatility. It is crucial to conduct thorough research and consider factors such as company performance, industry trends, and economic conditions before investing in stocks.

Real Estate

Real estate is another investment avenue known for its potential for high returns. Property values tend to appreciate over time, providing investors with the opportunity to generate significant profits. However, real estate investments also come with risks such as market fluctuations, maintenance costs, and liquidity issues. It is important to carefully evaluate the property market and conduct due diligence before investing in real estate.

Bonds

Bonds are considered a more conservative investment option compared to stocks and real estate. While they typically offer lower returns, they also come with lower risk levels. Bonds can provide investors with a steady stream of income through interest payments. It is crucial to assess the credit quality of bond issuers and understand the risks associated with different types of bonds before investing in them.

Alternative Investments, High-return investments for 2024

In addition to traditional investment options, alternative investments such as cryptocurrency, peer-to-peer lending, and startups have gained popularity in recent years. These investment opportunities offer the potential for high returns but also come with unique risks. Cryptocurrency, for example, is known for its volatility, while investing in startups carries the risk of failure. It is essential to diversify your investment portfolio and carefully evaluate the risks and rewards of alternative investments.

Investors should consider their risk tolerance, investment goals, and time horizon when selecting high-return investment options for 2024. By diversifying their portfolio and staying informed about market trends, investors can position themselves for success in the ever-changing investment landscape.

Market Trends and Analysis

In the ever-evolving landscape of investments, it is crucial to stay abreast of the current market trends that can significantly impact high-return opportunities. Geopolitical events, historical data, and emerging sectors all play a vital role in shaping the investment landscape for 2024.

Impact of Geopolitical Events

Geopolitical events have a profound impact on investment opportunities, as they can create volatility and uncertainty in the market. For instance, trade tensions between major economies can lead to fluctuations in stock prices and currency values. Investors need to closely monitor geopolitical developments to anticipate potential risks and opportunities for high-return investments.

Historical Data Analysis

Analyzing historical data is essential for predicting potential high-return sectors for 2024. By examining past trends and performance metrics, investors can identify emerging industries with growth potential. Sectors such as renewable energy, technology, and healthcare have shown promising returns in recent years, making them attractive investment options for the future.

Emerging Sectors for 2024

As we look ahead to 2024, certain sectors are poised for significant growth and high returns. Industries like artificial intelligence, sustainable infrastructure, and e-commerce are expected to flourish due to changing consumer preferences and technological advancements. Investors should consider diversifying their portfolios to capitalize on these emerging sectors and maximize their returns in the coming year.

Risk Management Strategies

When it comes to high-return investments, managing risks effectively is crucial to protect your capital and maximize returns. By implementing proper risk management strategies, investors can navigate volatile markets and increase their chances of success.

Diversification Strategies

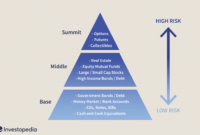

Diversification is a key risk management technique that involves spreading investments across different asset classes, sectors, and geographical regions. This helps reduce the impact of a single investment’s performance on the overall portfolio. By diversifying, investors can potentially lower their overall risk exposure while still aiming for high returns.

- Invest in a mix of assets: Consider allocating your investment capital across stocks, bonds, real estate, and other asset classes to reduce correlation risk.

- Explore different sectors: Investing in a variety of sectors such as technology, healthcare, and consumer goods can help mitigate sector-specific risks.

- International exposure: Consider investing in global markets to diversify geographically and reduce country-specific risks.

By diversifying your investment portfolio, you can potentially lower risk while maintaining the potential for high returns.

Balancing High-risk, High-reward Investments

Balancing high-risk, high-reward investments in a portfolio requires careful consideration and a strategic approach. While these investments offer the potential for significant returns, they also come with a higher level of risk. Here are some ways to balance high-risk investments effectively:

- Allocate a portion of your portfolio: Consider allocating a small percentage of your portfolio to high-risk, high-reward investments to limit exposure while still benefiting from potential gains.

- Monitor and adjust: Regularly review your portfolio and adjust your allocation based on market conditions and your risk tolerance. Rebalancing can help maintain the desired risk-return profile.

- Consider risk management tools: Utilize tools such as stop-loss orders, options, and hedging strategies to manage downside risk and protect your investments.

Investment Strategies: High-return Investments For 2024

When it comes to high-return investments, having a solid investment strategy is crucial for maximizing returns and managing risks effectively. In this section, we will explore different investment strategies, including short-term vs. long-term approaches, value investing, growth investing, and the importance of asset allocation in high-return investment planning.

Short-term vs. Long-term Investment Strategies

- Short-term investment strategies involve buying and selling assets within a relatively short period, often taking advantage of market fluctuations or specific events to generate quick profits.

- Long-term investment strategies, on the other hand, focus on holding assets for an extended period, allowing for the potential growth and compounding of returns over time.

- It’s essential to consider your financial goals, risk tolerance, and investment horizon when choosing between short-term and long-term strategies.

Value Investing and Growth Investing

- Value investing involves identifying undervalued assets that are trading below their intrinsic value, aiming to profit from their potential price appreciation as the market corrects its mispricing.

- Growth investing, on the other hand, focuses on investing in companies with strong growth potential, even if their current valuations may be relatively high, betting on future earnings growth to drive returns.

- Both value and growth investing strategies have their merits and risks, and combining elements of both approaches can help diversify a high-return investment portfolio.

Importance of Asset Allocation

- Asset allocation involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities, to reduce risk and optimize returns.

- By diversifying your portfolio through asset allocation, you can mitigate the impact of market volatility on your investments and take advantage of various market trends and opportunities.

- Regularly reviewing and rebalancing your asset allocation based on your financial goals and risk tolerance is essential for maintaining a well-structured high-return investment portfolio.

In conclusion, High-return investments for 2024 offer a wealth of opportunities for savvy investors looking to grow their portfolios. By understanding the market trends, managing risks effectively, and implementing smart investment strategies, you can set yourself up for financial success in the coming year.

As we look ahead to the future of automotive technology, the new features in 2025 car models are shaping up to be revolutionary. From advanced autonomous driving capabilities to cutting-edge safety systems, these next-generation vehicles are set to redefine the driving experience. To learn more about the exciting innovations coming to 2025 car models, check out this comprehensive guide on New features in 2025 car models.

As we look ahead to 2025, car enthusiasts are buzzing with excitement over the new features expected in upcoming models. From advanced autonomous driving capabilities to cutting-edge connectivity options, the new features in 2025 car models promise to revolutionize the driving experience. Manufacturers are focusing on enhancing safety, efficiency, and comfort, making these vehicles truly futuristic marvels on wheels.