High ROI startup investment. Embark on a journey into the world of lucrative opportunities and smart investments, where success is waiting to be discovered and harnessed.

Explore the key factors, strategies, risks, and FAQs surrounding high ROI startup investments to unlock the potential for exceptional returns in the dynamic startup landscape.

What is a high ROI startup investment?

Investing in startups with high Return on Investment (ROI) potential can lead to significant gains for investors. In the context of startup investments, high ROI refers to the substantial return that investors receive on their initial investment over a specific period.

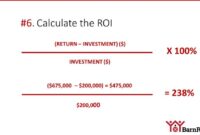

ROI in startup investments is calculated by dividing the net profit generated from the investment by the initial investment cost, then multiplying by 100 to get a percentage. The formula for ROI is as follows:

ROI = (Net Profit / Initial Investment) x 100

Examples of successful high ROI startup investments

Successful high ROI startup investments are not only financially rewarding but also showcase the potential for exponential growth. Some notable examples include:

- Uber: The ride-sharing platform started as a startup and achieved a high ROI for early investors due to its rapid growth and disruption of the transportation industry.

- Instagram: Acquired by Facebook for $1 billion, Instagram’s early investors saw a substantial ROI as the platform became one of the most popular social media networks globally.

- Slack: The workplace communication tool experienced significant growth and was later acquired by Salesforce for $27.7 billion, resulting in a high ROI for early backers.

Factors influencing high ROI startup investments: High ROI Startup Investment.

When it comes to achieving high ROI in startup investments, several key factors play a crucial role in determining the success of an investment. These factors can range from market conditions to the strength of the team driving the startup. Understanding and analyzing these factors can help investors make informed decisions and maximize their returns.

Importance of Market Research

Market research is a critical component in identifying high ROI opportunities in startup investments. By conducting thorough market research, investors can gain valuable insights into market trends, customer needs, and competitive landscapes. This information can help investors identify niche markets, emerging trends, and untapped opportunities that have the potential for high returns on investment. Additionally, market research can help investors assess the scalability and sustainability of a startup, which are key factors in determining long-term ROI.

Impact of a Strong Team, High ROI startup investment.

Having a strong and capable team is another crucial factor that can significantly impact the ROI of a startup investment. A team with diverse skills, experience, and a shared vision can effectively navigate challenges, make strategic decisions, and drive the growth of a startup. A strong team can also attract top talent, strategic partnerships, and investors, which can further enhance the success and profitability of a startup. Investors should carefully evaluate the team behind a startup to ensure they have the expertise and drive to execute their business plan and deliver high ROI.

Strategies for maximizing ROI in startup investments

Investing in startups can be risky, but when done right, it can also yield high returns on investment. To maximize ROI in startup investments, it is essential to implement strategic tactics that focus on reducing costs, maximizing revenues, fostering innovation, and ensuring scalability.

Reducing Costs and Maximizing Revenues

One effective strategy for maximizing ROI in startup investments is to focus on reducing costs while simultaneously maximizing revenues. This can be achieved through various tactics such as lean startup methodologies, efficient resource allocation, and effective budget management. By keeping costs low and revenues high, startups can improve their profitability and ultimately increase their ROI.

- Implementing lean startup methodologies to minimize waste and optimize resources.

- Utilizing cost-effective marketing strategies to reach target customers without overspending.

- Negotiating favorable terms with suppliers and vendors to lower expenses.

- Diversifying revenue streams to increase overall income and reduce dependency on a single source.

The Role of Innovation and Scalability

Innovation and scalability play a crucial role in achieving high ROI in startup investments. Startups that focus on developing innovative products or services that address market needs and trends are more likely to attract customers and generate higher revenues. Additionally, scalability allows startups to grow their operations efficiently and expand their market reach, ultimately leading to increased profitability and ROI.

- Investing in research and development to create unique and disruptive solutions that set the startup apart from competitors.

- Leveraging technology to streamline processes, improve efficiency, and enhance the overall customer experience.

- Building a scalable business model that can easily adapt to changing market conditions and accommodate growth.

- Establishing strategic partnerships and collaborations to access new markets and opportunities for expansion.

Examples of Successful Strategies

Several successful startups have employed effective strategies to maximize ROI and achieve significant growth. For instance, companies like Airbnb utilized a peer-to-peer business model to disrupt the hospitality industry, while Uber leveraged technology to revolutionize the transportation sector. By focusing on innovation, scalability, and cost-effective operations, these startups were able to generate substantial returns for their investors and stakeholders.

- Airbnb’s strategic partnership with hosts allowed them to scale rapidly and offer unique accommodations to travelers worldwide.

- Uber’s use of a mobile app and dynamic pricing algorithms revolutionized the way people commute and paved the way for the gig economy.

- Slack’s focus on user experience and collaboration tools positioned them as a leader in the workplace communication space, leading to a successful IPO.

- Stripe’s emphasis on simplifying online payments and providing developer-friendly tools contributed to their rapid growth and valuation as a fintech unicorn.

Risks associated with high ROI startup investments

When considering high ROI startup investments, it is important to acknowledge the risks involved. While the potential returns can be enticing, there are several factors that can pose challenges and impact the success of the investment. Understanding these risks and knowing how to mitigate them is crucial for protecting your capital and maximizing your returns.

Common Risks Involved in High ROI Startup Investments

- Market Risk: Startups operate in a volatile market environment where factors like competition, changing consumer preferences, and economic conditions can affect their success.

- Operational Risk: Startups often face challenges in scaling their operations, managing resources effectively, and adapting to unforeseen circumstances.

- Team Risk: The success of a startup heavily relies on the skills and expertise of its founding team. Issues like team dynamics, talent retention, and leadership changes can impact the startup’s performance.

- Financial Risk: Startups may struggle with securing funding, managing cash flow, and achieving profitability, which can threaten the sustainability of the business.

- Regulatory Risk: Startups need to navigate complex regulatory frameworks, compliance requirements, and legal challenges, which can hinder their growth and expansion.

Ways to Mitigate Risks and Protect Investments

- Conduct thorough due diligence before making an investment to assess the startup’s viability, market potential, and competitive landscape.

- Diversify your investment portfolio to spread risk across different startups and industries, reducing the impact of potential losses.

- Establish clear investment criteria and risk management strategies to guide your decision-making process and minimize exposure to high-risk ventures.

- Stay informed about market trends, industry developments, and regulatory changes to anticipate risks and proactively address challenges.

Examples of How Risks Can Impact the ROI of a Startup Investment

- Market risk: A sudden shift in consumer behavior leads to a decline in demand for the startup’s product, resulting in lower revenue and profitability.

- Team risk: Key members of the founding team decide to leave the startup, causing disruptions in operations and strategic direction, impacting the overall performance.

- Financial risk: The startup fails to secure additional funding rounds, leading to cash flow issues and potential bankruptcy, resulting in a complete loss of investment.

In conclusion, High ROI startup investment. offers a promising avenue for those seeking substantial returns and strategic investment opportunities. By understanding the intricacies of successful startup investments, investors can navigate the risks and capitalize on the rewards in this competitive arena.

As we look ahead to 2024, it’s crucial for investors to stay informed about the latest investment trends to watch in 2024. With the ever-changing market landscape, understanding these trends can make a significant impact on your investment decisions. From emerging technologies to global economic shifts, keeping an eye on these trends will help you navigate the complex world of investing with confidence.

As we look ahead to 2024, it’s essential to stay informed about the latest investment trends shaping the financial landscape. Keeping an eye on key indicators and market shifts can help investors make more informed decisions. To stay ahead of the curve, check out this insightful guide on Investment trends to watch in 2024 for valuable insights and predictions.