Kicking off with How to analyze real estate investment deals, this opening paragraph is designed to captivate and engage the readers, setting the tone semrush author style that unfolds with each word.

Real estate investment deals can be lucrative opportunities, but understanding how to analyze them is crucial for success. From evaluating market conditions to financial analysis and negotiating deals, this guide covers everything you need to know to make informed investment decisions.

Understanding Real Estate Investment Deals

Real estate investment deals refer to the transactions or agreements made to acquire, manage, or sell properties with the goal of generating a profit. These deals involve various strategies and approaches depending on the investor’s objectives and the type of property involved.

Key Components of a Real Estate Investment Deal

- Property Valuation: Determining the value of the property is crucial to assess its potential for return on investment.

- Financing: Securing funds to purchase the property, whether through loans, partnerships, or personal investment.

- Market Analysis: Understanding the local real estate market trends and dynamics to make informed decisions.

- Risk Assessment: Evaluating the risks associated with the investment, such as market fluctuations, location factors, and property condition.

- Exit Strategy: Planning how to profit from the investment, whether through resale, rental income, or property development.

Types of Real Estate Investment Deals

- Fix and Flip: Involves purchasing a property below market value, renovating it, and selling it at a higher price for a quick profit.

- Rental Properties: Acquiring properties to rent out to tenants and generate passive income through monthly rental payments.

- Commercial Real Estate: Investing in properties such as office buildings, retail spaces, or industrial complexes for leasing or resale.

Evaluating Market Conditions

Market analysis is a crucial aspect of real estate investment as it helps investors make informed decisions based on current trends and future projections. By evaluating market conditions, investors can determine the potential risks and returns associated with a particular property. Understanding how market trends can impact real estate deals is essential for maximizing profits and minimizing losses.

Methods to Research and Analyze Local Real Estate Market Conditions

- Utilize online real estate platforms and databases to gather data on recent sales, rental prices, and property listings in the target area.

- Consult local real estate agents and experts to gain insights into market trends, upcoming developments, and investment opportunities.

- Analyze demographic and economic data to understand the demand for housing in the area and forecast future growth.

- Monitor local government policies, zoning regulations, and infrastructure projects that could impact property values and investment potential.

How Market Trends Impact Real Estate Investment Deals, How to analyze real estate investment deals

- Market trends such as increasing demand, declining supply, or shifting demographics can influence property prices and rental yields.

- Fluctuations in interest rates, inflation, and economic conditions can affect financing costs and overall investment returns.

- Changes in consumer preferences, lifestyle trends, and technological advancements can create new opportunities for real estate investors.

- Understanding market trends allows investors to anticipate future changes and adjust their investment strategies accordingly to maximize profits.

Financial Analysis of Investment Deals

Real estate investment deals require a thorough financial analysis to determine their potential profitability. This involves calculating key metrics such as Return on Investment (ROI), cash flow analysis, and assessing the associated risks and rewards.

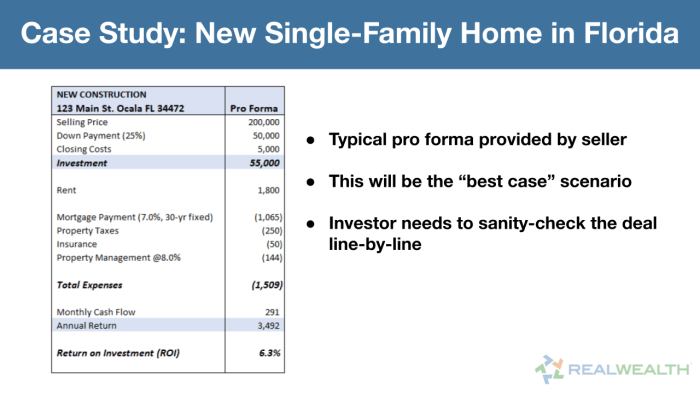

Calculating ROI for Real Estate Deals

Return on Investment (ROI) is a critical metric used to evaluate the profitability of a real estate investment. To calculate ROI, use the following formula:

ROI = (Net Profit / Cost of Investment) x 100

Net profit includes rental income, appreciation, and any other income generated from the property, while the cost of investment encompasses the purchase price, closing costs, and renovation expenses. A higher ROI indicates a more lucrative investment opportunity.

Cash Flow Analysis in Real Estate Investments

Cash flow analysis involves assessing the income generated from a real estate investment after deducting operating expenses such as mortgage payments, property taxes, insurance, and maintenance costs. Positive cash flow is crucial for ensuring the sustainability of the investment and can be calculated using the formula:

Cash Flow = Rental Income – Operating Expenses

A positive cash flow indicates that the property is generating more income than it costs to maintain, making it a viable investment option.

Assessing Risks and Rewards of Real Estate Investment Deals

When evaluating real estate investment deals, it is essential to consider the potential risks and rewards involved. Risks may include market fluctuations, vacancies, unexpected repairs, or changes in regulations. On the other hand, rewards can include rental income, property appreciation, tax benefits, and portfolio diversification. Conducting a thorough risk assessment and weighing it against potential rewards is crucial in making informed investment decisions.

Due Diligence Process: How To Analyze Real Estate Investment Deals

When it comes to real estate investment deals, conducting due diligence is a crucial step in ensuring the success and profitability of the investment. Due diligence involves thoroughly examining all aspects of the property and the deal to uncover any potential issues or risks that could impact the investment.

Steps Involved in Due Diligence

Conducting due diligence for real estate investment deals involves several key steps:

- Property Inspections: Inspecting the property thoroughly to identify any structural issues, damages, or necessary repairs.

- Title Searches: Verifying the property’s title to ensure there are no liens, encumbrances, or legal issues that could affect ownership.

- Financial Analysis: Reviewing the financials of the property, including income and expenses, to assess its profitability and potential for growth.

- Legal Considerations: Consulting with legal professionals to review contracts, leases, zoning laws, and other legal documents related to the property.

Importance of Due Diligence

Property inspections, title searches, and legal considerations play a vital role in due diligence for real estate investment deals:

- Property Inspections: Helps in identifying any hidden issues or problems with the property that could impact its value or potential for future returns.

- Title Searches: Ensures that the property has a clear title and is free of any legal disputes that could lead to complications or financial loss.

- Legal Considerations: Helps in understanding the legal aspects of the deal, protecting the investor from potential lawsuits, disputes, or breaches of contract.

Common Pitfalls to Avoid

During the due diligence process, it is essential to be aware of common pitfalls that investors should avoid:

- Relying solely on seller-provided information without verifying its accuracy through independent sources.

- Not conducting thorough property inspections, leading to unexpected repair costs or issues post-purchase.

- Skipping legal review or title searches, which can result in legal disputes, ownership challenges, or financial liabilities.

Negotiating and Structuring Deals

When it comes to real estate investment deals, negotiating favorable terms and structuring the deal effectively can significantly impact your returns. Here are some tips and insights to help you maximize your opportunities:

Negotiating Favorable Terms

- Do your research: Understand the market conditions, property values, and comparable sales to support your negotiation position.

- Be flexible: Consider offering other incentives or adjusting terms to meet the seller’s needs while still aligning with your investment goals.

- Build relationships: Establishing a good rapport with the seller can help in negotiations and potentially lead to more favorable terms.

- Seek professional advice: Consider working with a real estate agent or attorney to help navigate the negotiation process and ensure you are making informed decisions.

Deal Structuring Options

- Buy and hold: Purchase the property with the intention of holding it for a longer period, allowing for appreciation and potential rental income.

- Fix and flip: Acquire a property that needs renovations, improve it, and sell it at a higher price for a quick profit.

- Joint ventures: Partner with other investors or developers to pool resources and expertise for larger or more complex projects.

- Seller financing: Negotiate terms with the seller where they provide financing for the purchase, offering potential benefits such as lower closing costs or flexible terms.

Leveraging Financing Options

- Traditional mortgages: Explore options with banks or financial institutions to secure a mortgage loan for the property purchase.

- Private lenders: Consider working with private lenders or hard money lenders for quicker financing options, albeit at potentially higher interest rates.

- Creative financing: Look into seller financing, lease options, or other creative financing strategies to structure deals that work best for your investment goals.

- Use leverage wisely: While financing can help amplify your returns, be mindful of the risks associated with high leverage and ensure you have a solid repayment plan in place.

In conclusion, mastering the art of analyzing real estate investment deals is key to building a successful portfolio. By following the strategies Artikeld in this guide, you’ll be equipped to navigate the complexities of the real estate market and make sound investment choices.

When it comes to investing, tax efficiency is a crucial aspect for investors to consider. One option to explore is investing in tax-efficient mutual funds that can help minimize tax liabilities while still providing potential returns. By choosing funds that are structured to be tax-efficient, investors can optimize their investment growth and potentially increase their after-tax returns.

Investors looking to optimize their tax efficiency should consider investing in tax-efficient mutual funds. These funds are designed to minimize tax liabilities, allowing investors to keep more of their returns. By utilizing strategies such as tax-loss harvesting and investing in municipal bonds, investors can benefit from potential tax savings while still achieving their financial goals.