Kicking off with How to diversify your real estate portfolio, this opening paragraph is designed to captivate and engage the readers, setting the tone for what’s to come. Diving into the world of real estate investment diversification is crucial for long-term success and financial stability. By exploring different types of investments, geographical locations, and strategic approaches, you can enhance your portfolio and minimize risks. Let’s delve deeper into the art of diversifying your real estate investments.

Why Diversify Real Estate Portfolio?: How To Diversify Your Real Estate Portfolio

When it comes to investing in real estate, diversification plays a crucial role in managing risk and maximizing returns. By spreading your investments across different types of properties, locations, and markets, you can reduce the impact of any specific downturn or market volatility on your overall portfolio.

Importance of Diversification, How to diversify your real estate portfolio

Diversification in a real estate portfolio helps to minimize the risks associated with overexposure to a single asset class or market segment. For example, if you have all your investments in residential properties in a single city, you are more vulnerable to local economic conditions, changes in rental demand, or regulatory changes that could negatively impact your portfolio.

When it comes to generating passive income, one lucrative option is real estate investing. By investing in properties, you can earn rental income without actively managing the day-to-day operations. This form of investment offers long-term benefits and can be a reliable source of passive income for the future.

By diversifying your real estate holdings to include a mix of residential, commercial, retail, and industrial properties across different geographic regions, you can spread out these risks and potentially enhance your overall returns.

Real estate investing for passive income is a smart way to generate wealth without actively working. By purchasing properties and renting them out, investors can earn a steady stream of income. However, it’s essential to research the market, understand the risks involved, and have a solid financial plan in place. To learn more about real estate investing for passive income, check out this comprehensive guide: Real estate investing for passive income.

Risks of Non-Diversified Portfolio

- Market Concentration Risk: Investing only in one type of property or market segment can leave you exposed to fluctuations in that specific market, such as a decline in housing prices or a downturn in the commercial real estate sector.

- Regulatory Risk: Changes in local regulations or zoning laws can have a significant impact on the value and profitability of your real estate investments, especially if all your properties are concentrated in one area.

- Liquidity Risk: In the event of an economic downturn or a need to sell properties quickly, a non-diversified portfolio may struggle to generate cash flow or find buyers, leading to potential financial difficulties.

Benefits of Diversification

- Reduced Risk: Diversifying your real estate portfolio helps to spread risk across different assets and markets, reducing the impact of any single negative event on your overall investment performance.

- Enhanced Returns: By investing in a variety of property types and locations, you can capture opportunities for growth and income in different market conditions, potentially increasing your overall returns over time.

- Portfolio Stability: A diversified real estate portfolio is more resilient to market fluctuations, economic downturns, and regulatory changes, providing a more stable and predictable income stream for investors.

Types of Real Estate Investments

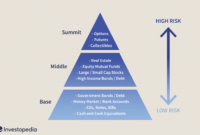

Residential, commercial, industrial, and retail real estate are common types of real estate investments that offer different opportunities for diversification. Each type comes with its own set of advantages and disadvantages, making it crucial for investors to understand the nuances of each before deciding where to allocate their resources.

Residential Real Estate

Residential real estate includes properties such as single-family homes, apartments, townhouses, and condominiums. Investing in residential real estate can provide a steady stream of rental income and potential for long-term appreciation. However, it may also come with challenges such as dealing with tenants, property maintenance, and market fluctuations.

Commercial Real Estate

Commercial real estate involves properties used for business purposes, such as office buildings, retail spaces, and warehouses. This type of investment can offer higher rental yields compared to residential properties, but it may also require more capital upfront and involve longer lease terms. Commercial real estate can be influenced by economic factors and market demand, making it essential for investors to conduct thorough research before entering this sector.

Industrial Real Estate

Industrial real estate comprises properties like manufacturing facilities, distribution centers, and storage units. Investing in industrial real estate can provide stable cash flow and long-term growth potential, especially with the rise of e-commerce and logistics industries. However, industrial properties may require specialized knowledge and maintenance due to their unique operational requirements.

Retail Real Estate

Retail real estate includes properties like shopping centers, strip malls, and standalone stores. Investing in retail real estate can offer a diversified income stream from multiple tenants, but it may also be impacted by shifts in consumer behavior and competition from online retailers. Retail properties require careful tenant selection and management to ensure consistent returns.

Successful real estate diversification across multiple property types can help investors mitigate risks and capitalize on various market opportunities. By carefully evaluating the pros and cons of each type of real estate investment, investors can build a well-rounded portfolio that aligns with their financial goals and risk tolerance.

Geographical Diversification

Geographical diversification in real estate investments is a strategy that involves spreading your real estate holdings across different locations. This approach helps reduce risk exposure to any one specific market and can potentially increase overall returns by tapping into diverse market conditions.

Investing in different locations allows investors to benefit from varying economic cycles, demographics, job growth, and demand for real estate. Identifying diverse real estate markets involves conducting thorough research on factors such as population growth, employment opportunities, infrastructure development, and market trends.

Identifying Diverse Real Estate Markets

- Research local economic indicators such as job growth, income levels, and industry diversity.

- Consider population trends and demographics to understand housing demand and rental potential.

- Assess the stability of the local real estate market by analyzing historical price trends and sales volume.

- Look into future development plans and infrastructure projects that can impact property values.

Benefits and Challenges of Investing in Different Locations

- Benefits:

- Diversification reduces risk by spreading investments across multiple markets.

- Potential for higher returns as different markets may experience growth at different times.

- Access to a wider range of investment opportunities and property types.

- Challenges:

- Managing properties in multiple locations can be complex and time-consuming.

- Market research and due diligence are essential to avoid investing in underperforming markets.

- Regulatory and tax differences across locations can impact investment returns.

Investment Strategies for Diversification

When it comes to diversifying your real estate portfolio, there are several investment strategies you can consider. These strategies can help you spread your risk and potentially increase your returns. Let’s explore some of the common investment strategies for diversification in real estate:

REITs (Real Estate Investment Trusts)

REITs are a popular way to invest in real estate without directly owning properties. By investing in REITs, you can gain exposure to different types of real estate assets such as residential, commercial, or industrial properties. This can help diversify your portfolio and reduce risk.

Real Estate Crowdfunding

Real estate crowdfunding platforms allow investors to pool their money together to invest in real estate projects. This strategy enables you to diversify your portfolio by investing in multiple properties across different locations and asset classes.

Property Flipping

Property flipping involves buying properties at a lower price, renovating or improving them, and then selling them for a profit. While this strategy can be more hands-on and risky, it can also provide higher returns if executed successfully. Property flipping can be a way to diversify your real estate investments by adding a different approach to your portfolio.

Active vs. Passive Real Estate Investment Approaches

Active real estate investing involves hands-on management of properties, such as buying, managing, and selling properties directly. On the other hand, passive real estate investing includes strategies like investing in REITs or real estate crowdfunding, where you are not directly involved in the day-to-day operations of the properties. Both approaches have their pros and cons, and the choice between active and passive investing depends on your risk tolerance, time commitment, and investment goals.

Balancing Risk and Return through Strategic Diversification

Strategic diversification in real estate involves spreading your investments across different types of properties, locations, and investment strategies to reduce risk and optimize returns. By diversifying strategically, you can balance the potential risks and rewards of your real estate portfolio. For example, you can combine stable income-producing properties with higher-risk, higher-reward opportunities to create a well-rounded portfolio that can weather market fluctuations.

In conclusion, mastering the art of diversifying your real estate portfolio is key to maximizing returns and minimizing risks. By implementing the strategies discussed and staying informed about market trends and opportunities, you can build a robust and successful real estate portfolio. Start diversifying today and watch your investments flourish in the ever-changing real estate landscape.