Kicking off with Low-risk, high ROI investment options, this opening paragraph is designed to captivate and engage the readers, setting the tone semrush author style that unfolds with each word.

When it comes to investing, finding opportunities that offer low risk and high returns is the ultimate goal for many. In this comprehensive guide, we will delve into various types of investments that fit this criteria, factors to consider when making investment decisions, and real-life case studies showcasing successful strategies. Get ready to discover a world of lucrative investment options that promise security and profitability.

Types of Low-risk, High ROI Investments: Low-risk, High ROI Investment Options

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png?w=700)

When it comes to investing, finding options that offer a high return on investment while minimizing risk is a top priority for many investors. Low-risk, high ROI investments are attractive as they provide the potential for significant gains without subjecting investors to substantial risk.

Low-risk, high ROI investments are characterized by their ability to generate above-average returns while preserving capital. These investments typically have a lower level of risk compared to other investment options, making them appealing to risk-averse investors looking to grow their wealth steadily over time.

Dividend-Paying Stocks, Low-risk, high ROI investment options

One popular type of low-risk, high ROI investment is dividend-paying stocks. These stocks belong to stable and established companies that have a history of distributing a portion of their profits to shareholders in the form of dividends. Dividend-paying stocks offer investors the potential for capital appreciation along with regular income from dividends.

- Examples: Companies like Johnson & Johnson, Coca-Cola, and Procter & Gamble are known for their consistent dividend payments and long-term growth potential.

- Characteristics: Dividend-paying stocks are considered low-risk as they are typically issued by financially stable companies with a track record of profitability. The regular income from dividends provides a cushion against market volatility, making these investments less susceptible to drastic price fluctuations.

Government Bonds

Another common low-risk, high ROI investment option is government bonds. These bonds are issued by governments and are considered to be one of the safest investment vehicles available. Government bonds offer a fixed rate of return over a specified period, making them a reliable source of income for investors.

- Examples: U.S. Treasury bonds, German bunds, and Japanese government bonds are popular choices for investors seeking low-risk investments with guaranteed returns.

- Characteristics: Government bonds are considered low-risk due to the backing of the issuing government, which reduces the likelihood of default. The fixed interest payments provide investors with a steady income stream, while the principal amount is typically returned at maturity, making government bonds a secure investment option.

Factors to Consider When Choosing Investments

When selecting low-risk, high ROI investment options, it is crucial to consider various factors to ensure a well-balanced and successful portfolio. These factors play a significant role in determining the risk-return profile and overall performance of your investments.

Risk-Return Profile Comparison

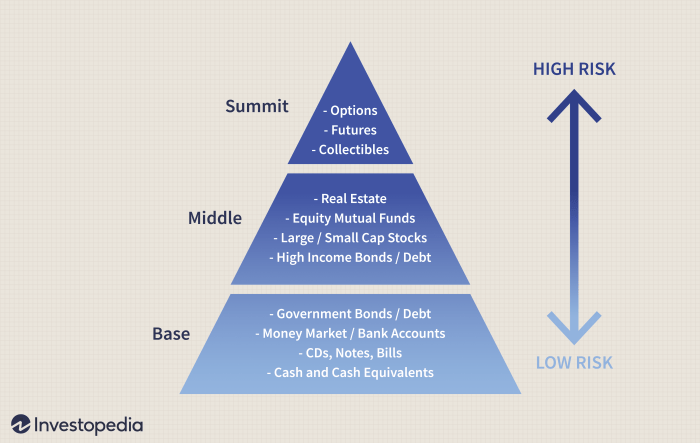

- One of the key factors to consider is the risk-return profile of different investment choices. Low-risk investments typically offer lower returns compared to high-risk investments. It is essential to analyze the risk associated with each investment option and evaluate the potential returns to make an informed decision.

- High ROI investments may come with higher levels of risk, such as market volatility or economic uncertainties. On the other hand, low-risk investments like government bonds or savings accounts offer more stability but lower returns. It is crucial to strike a balance between risk and return based on your financial goals and risk tolerance.

- Diversification is another critical factor to consider when choosing investments. By spreading your investments across various asset classes, sectors, and geographical regions, you can reduce the overall risk of your portfolio. Diversification helps in offsetting losses from one investment with gains from another, providing a more stable and consistent return over time.

Real-life Case Studies

Investing in low-risk, high ROI options can be a lucrative strategy when done correctly. Let’s explore some real-life case studies that exemplify successful investments with minimal risk and high returns.

Case Study 1: Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) have been a popular choice for investors looking for stable returns with low risk. One successful case study involves a group of investors pooling their resources to invest in a diversified portfolio of commercial properties through a REIT. By spreading their investments across different properties and sectors, they were able to minimize risks associated with individual properties while enjoying consistent rental income and capital appreciation. The key strategy here was diversification, which helped them achieve high returns without exposing themselves to significant risks.

Case Study 2: Dividend-paying Stocks

Another example of a low-risk, high ROI investment is dividend-paying stocks. In a case study, an investor focused on investing in well-established companies with a history of paying out dividends consistently. By reinvesting the dividends received, the investor was able to benefit from compounding returns over time. The strategy here was to choose companies with strong fundamentals and a track record of dividend payments, ensuring a steady income stream while also benefiting from potential capital gains.

Case Study 3: Government Bonds

Government bonds are often considered a safe investment option with low risk and moderate returns. In a case study, an investor allocated a portion of their portfolio to government bonds to preserve capital and generate stable income. By investing in bonds issued by financially stable governments, the investor was able to protect their capital while earning a predictable return. The key lesson learned here is the importance of balancing risk and return, especially in times of economic uncertainty.

These case studies highlight the effectiveness of investing in low-risk, high ROI options when approached strategically. By diversifying investments, focusing on stable income streams, and considering risk factors, investors can achieve attractive returns with minimal downside. It’s essential to learn from these examples and apply similar principles to your investment decisions to maximize profitability while safeguarding your capital.

In conclusion, Low-risk, high ROI investment options present a unique opportunity for investors to grow their wealth steadily while minimizing exposure to risk. By carefully considering various factors and learning from real-life case studies, individuals can make informed decisions to achieve financial success. Start exploring these lucrative investment opportunities today and pave the way for a secure financial future.

Real estate crowdfunding investment is a popular way for individuals to invest in properties without the hassle of being a landlord. With platforms like Real estate crowdfunding investment , investors can pool their money together to invest in real estate projects, allowing them to diversify their portfolio and potentially earn passive income. This method provides opportunities for both seasoned investors and newcomers to enter the real estate market with lower capital requirements.

Real estate crowdfunding investment is a modern way for investors to diversify their portfolios. By pooling funds with other investors, individuals can gain access to real estate projects that were once only available to large corporations or wealthy individuals. Platforms like Real estate crowdfunding investment offer opportunities for passive income and potential high returns without the hassle of managing properties directly.