Mutual funds vs ETFs: Which is better? This comparison uncovers key differences and insights into these popular investment options. Get ready to explore the pros and cons in detail.

Delve into the world of mutual funds and ETFs to make informed investment decisions based on cost, liquidity, diversification, tax efficiency, performance, and accessibility.

Introduction

Mutual funds and ETFs are popular investment options for individuals looking to diversify their portfolios. Mutual funds are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. On the other hand, ETFs (Exchange-Traded Funds) are similar to mutual funds but trade on stock exchanges like individual stocks.

Brief History of Mutual Funds and ETFs

Mutual funds have been around for over a century, with the first mutual fund established in the Netherlands in the 18th century. In the United States, mutual funds gained popularity in the 1920s and have since become a staple in the investment industry. ETFs, on the other hand, are a more recent development, with the first ETF launched in 1993. Since then, ETFs have grown in popularity due to their lower costs and tax efficiency compared to mutual funds.

Key Differences Between Mutual Funds and ETFs

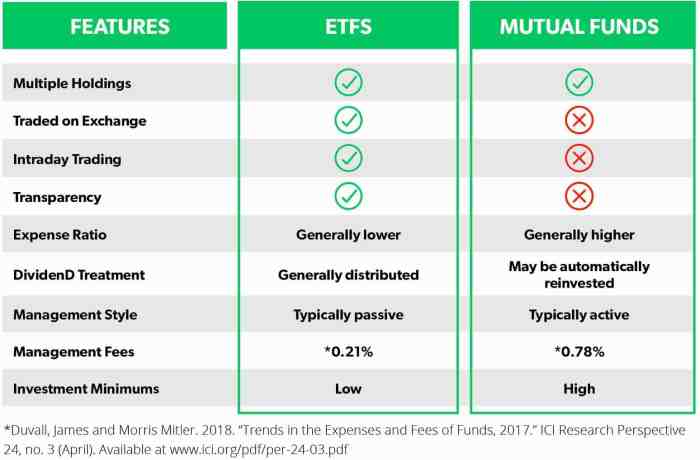

- Mutual funds are priced once a day after the market closes, while ETFs are traded throughout the day on stock exchanges.

- Mutual funds are bought and sold directly from the fund company at the end-of-day net asset value (NAV), while ETFs are bought and sold through a brokerage at market prices.

- Mutual funds may have minimum investment requirements, while ETFs can be purchased in individual shares.

- ETFs tend to have lower expense ratios compared to mutual funds, making them a more cost-effective option for investors.

- Mutual funds are actively managed by fund managers, while most ETFs are passively managed to track a specific index or sector.

Costs and Fees

When considering whether to invest in mutual funds or ETFs, one significant factor to take into account is the costs and fees associated with each type of investment. These expenses can have a substantial impact on the overall returns for investors, so it is crucial to understand the breakdown of expenses, including expense ratios, management fees, and other costs.

Expense Ratios

Expense ratios are a key cost associated with both mutual funds and ETFs. This ratio represents the percentage of a fund’s assets that goes towards covering operating expenses. Mutual funds typically have higher expense ratios compared to ETFs. The average expense ratio for mutual funds is around 0.5% to 1.0%, while ETFs usually have lower expense ratios ranging from 0.1% to 0.5%. These lower expense ratios for ETFs can result in higher returns for investors over time.

Management Fees

In addition to expense ratios, investors need to consider management fees. Mutual funds often charge higher management fees compared to ETFs. These fees are paid to the fund managers for overseeing the investment portfolio. The average management fee for mutual funds can range from 0.5% to 1.0%, while ETFs typically have lower management fees ranging from 0.1% to 0.5%. Lower management fees for ETFs can help investors save on costs and potentially increase their overall returns.

Other Costs

Apart from expense ratios and management fees, there may be other costs associated with investing in mutual funds or ETFs. These costs can include trading costs, sales loads, and administrative fees. Mutual funds are more likely to have sales loads, which are charges either when purchasing (front-end load) or selling (back-end load) shares in the fund. ETFs, on the other hand, generally do not have sales loads. Additionally, ETFs are traded on an exchange like a stock, so investors may incur brokerage fees when buying or selling ETF shares.

Understanding the costs and fees associated with mutual funds and ETFs is essential for investors to make informed decisions and maximize their investment returns.

Liquidity and Trading: Mutual Funds Vs ETFs: Which Is Better?

When it comes to investing in mutual funds and ETFs, understanding liquidity and trading is crucial for making informed decisions. Liquidity refers to how easily you can buy or sell an investment without significantly impacting its price. Trading, on the other hand, involves the process of buying and selling securities within a fund.

Liquidity Differences

- Mutual funds are typically less liquid than ETFs. This is because mutual funds are only traded once per day after the market closes, at the net asset value (NAV). In contrast, ETFs trade on an exchange throughout the day at market prices.

- ETFs can be bought and sold at any time during market hours, providing investors with more flexibility compared to mutual funds.

- Since ETFs trade on exchanges, their prices may fluctuate throughout the day based on supply and demand, unlike mutual funds which have a fixed price at the end of the trading day.

Trading Process

- When trading mutual funds, investors submit orders to buy or sell shares at the end of the trading day. The transaction is executed at the NAV price calculated based on the fund’s holdings.

- ETF trading involves buying or selling shares through a brokerage account at prevailing market prices. Investors can place limit orders, stop orders, or market orders to execute trades.

- ETF trading costs may include brokerage commissions, bid-ask spreads, and other fees, which can impact overall returns.

Impact on Investment Strategies

- The liquidity of ETFs allows investors to react quickly to market movements and take advantage of short-term trading opportunities.

- Mutual funds are better suited for long-term investors who are not concerned with intra-day price fluctuations and are comfortable with the end-of-day trade execution.

- Investors should consider their investment goals, risk tolerance, and trading preferences when choosing between mutual funds and ETFs to ensure they align with their overall strategy.

Diversification

When it comes to investing, diversification is a key strategy to manage risk and optimize returns. Both mutual funds and ETFs offer investors a way to diversify their portfolios across a wide range of assets, but they may employ different strategies to achieve this goal.

Level of Diversification, Mutual funds vs ETFs: Which is better?

Mutual funds typically offer a higher level of diversification compared to individual stocks or bonds. By pooling money from multiple investors, mutual funds are able to invest in a broad range of securities, including stocks, bonds, and other assets. This diversification helps spread out risk and reduce the impact of a single investment performing poorly.

ETFs also provide diversification, as they hold a basket of assets that mirrors a particular index or sector. Investors can gain exposure to multiple companies or industries through a single ETF, offering a convenient way to diversify their portfolio without having to purchase individual securities.

Diversification Strategies

Mutual funds often follow a more actively managed approach to diversification, with fund managers selecting a mix of securities based on their investment objectives and research. This active management can lead to higher fees but may also result in potentially higher returns if the fund outperforms the market.

On the other hand, ETFs typically track a specific index or sector passively, aiming to replicate the performance of the underlying assets. This passive approach generally results in lower fees compared to actively managed mutual funds but may limit the potential for outperformance.

Impact on Risk Management

Diversification plays a crucial role in risk management for investors. By spreading investments across different asset classes, sectors, and regions, investors can reduce the impact of market volatility on their overall portfolio. Diversification helps mitigate the risk of significant losses from a single investment underperforming, providing a level of stability and protection for investors.

Overall, both mutual funds and ETFs offer investors the opportunity to diversify their portfolios effectively. The choice between the two will depend on individual investment goals, risk tolerance, and preferences for active or passive management strategies.

Tax Efficiency

When comparing mutual funds vs ETFs, it is important to consider the tax implications of each investment option. Tax efficiency can have a significant impact on your overall returns, so understanding how mutual funds and ETFs are taxed is crucial.

Capital Gains Distributions

One key difference between mutual funds and ETFs is how they distribute capital gains to investors. Mutual funds are required to distribute capital gains to shareholders at least once a year, which can lead to tax consequences for investors, even if they did not sell any shares. On the other hand, ETFs are generally more tax-efficient because they have less frequent capital gains distributions. This can result in lower tax liabilities for ETF investors compared to mutual fund investors.

Tax Efficiency Strategies

To maximize tax efficiency when investing in mutual funds or ETFs, consider the following strategies:

- Hold investments for the long term: By holding onto your investments for an extended period, you may benefit from lower long-term capital gains tax rates.

- Utilize tax-advantaged accounts: Investing in mutual funds or ETFs through tax-advantaged accounts like IRAs or 401(k)s can help reduce your tax burden.

- Consider tax-loss harvesting: Selling investments at a loss to offset capital gains can help minimize taxes owed on your investment gains.

Performance and Tracking

When it comes to evaluating the performance of mutual funds and ETFs, investors often look at how these investment vehicles track benchmark indices, historical performance, and factors influencing their overall returns.

Tracking Benchmark Indices

Both mutual funds and ETFs can be designed to track specific benchmark indices, such as the S&P 500 or the Russell 2000. Mutual funds typically aim to match the performance of the index by holding a portfolio of securities that mirrors the index’s composition. On the other hand, ETFs use a creation and redemption mechanism to closely follow the index’s performance.

Historical Performance Comparison

Historically, ETFs have often outperformed mutual funds in terms of expense ratios and tax efficiency due to their unique structure. However, it’s essential to consider that past performance is not indicative of future results, and various factors can influence the performance of both mutual funds and ETFs.

Influencing Factors

Factors such as management fees, turnover rates, tax implications, and market conditions can all impact the performance of mutual funds and ETFs. Additionally, the specific investment strategy employed by the fund manager or ETF provider can also play a significant role in determining returns.

Accessibility and Minimum Investments

When comparing mutual funds and ETFs, accessibility and minimum investment requirements play a crucial role in determining which investment option is better suited for individual investors. Let’s delve into the details.

Accessibility Options for Mutual Funds and ETFs

Accessibility refers to how easily investors can buy and sell shares of a particular investment product. Mutual funds are typically purchased directly from the fund company or through a brokerage account. On the other hand, ETFs trade on stock exchanges like individual stocks, allowing investors to buy and sell them throughout the trading day at market prices. This difference in accessibility can impact investor participation, as ETFs offer more flexibility in terms of trading.

Minimum Investment Requirements for Mutual Funds vs ETFs

Mutual funds often have higher minimum investment requirements compared to ETFs. Some mutual funds may require initial investments ranging from hundreds to thousands of dollars, making them less accessible to small investors. In contrast, ETFs do not have minimum investment requirements, allowing investors to purchase as little as one share at the current market price. This lower barrier to entry makes ETFs more accessible to a wider range of investors.

Impact of Accessibility on Investor Participation

The accessibility of an investment product can significantly impact investor participation. Mutual funds with high minimum investment requirements may deter small investors from participating, limiting their ability to diversify their portfolios. In contrast, the accessibility and lower cost of entry associated with ETFs can attract a broader range of investors, including those with limited capital. This increased accessibility can lead to greater investor participation in ETFs compared to mutual funds.

In conclusion, the battle between Mutual funds and ETFs continues as investors weigh the benefits and drawbacks of each. Choose wisely based on your financial goals and risk tolerance.

When it comes to investing, choosing the best platform is crucial for success. In 2024, investors are spoiled for choice with a variety of options available. However, it’s essential to do thorough research before making a decision. To help you navigate through the sea of investment platforms, check out this comprehensive list of the best investment platforms in 2024.

From traditional brokerage firms to innovative robo-advisors, this guide covers everything you need to know to make informed investment decisions.

Investing in 2024 can be made easier with the best investment platforms available. These platforms offer a wide range of options for investors, from stocks to cryptocurrencies. If you’re looking to maximize your investments, consider checking out the best investment platforms in 2024 for a comprehensive overview of your options.