Kicking off with Real estate investment trusts (REITs) explained, this opening paragraph is designed to captivate and engage the readers, providing an insightful overview of how REITs function and their significance in the real estate market. From defining REITs to exploring their different types and investment opportunities, this guide aims to demystify the world of real estate investment trusts for both novice and seasoned investors.

What are Real Estate Investment Trusts (REITs)?: Real Estate Investment Trusts (REITs) Explained

Real Estate Investment Trusts (REITs) are investment vehicles that allow individuals to invest in real estate assets without directly owning the properties themselves. REITs pool money from multiple investors to purchase, operate, and manage different types of real estate properties, such as commercial buildings, residential complexes, or even infrastructure projects.

Types of REITs

- Equity REITs: These REITs primarily own and operate income-producing real estate properties. Investors earn dividends from the rental income generated by these properties.

- Mortgage REITs: Mortgage REITs invest in mortgages or mortgage-backed securities, earning income from the interest on these loans rather than property rental income.

- Hybrid REITs: These REITs combine the features of both equity and mortgage REITs, investing in both properties and mortgages to diversify their revenue streams.

How do REITs work?

REITs, or Real Estate Investment Trusts, are investment vehicles that allow individuals to invest in a diversified portfolio of real estate assets without directly owning or managing the properties themselves. These trusts are traded on major stock exchanges, providing investors with the opportunity to earn income through dividends and capital appreciation.

Structure of REITs and Income Generation

REITs typically own and operate income-producing real estate, such as office buildings, shopping centers, apartments, and hotels. They generate income primarily through rental payments from tenants. The profits generated from these properties are distributed to shareholders in the form of dividends, making them an attractive option for income-seeking investors.

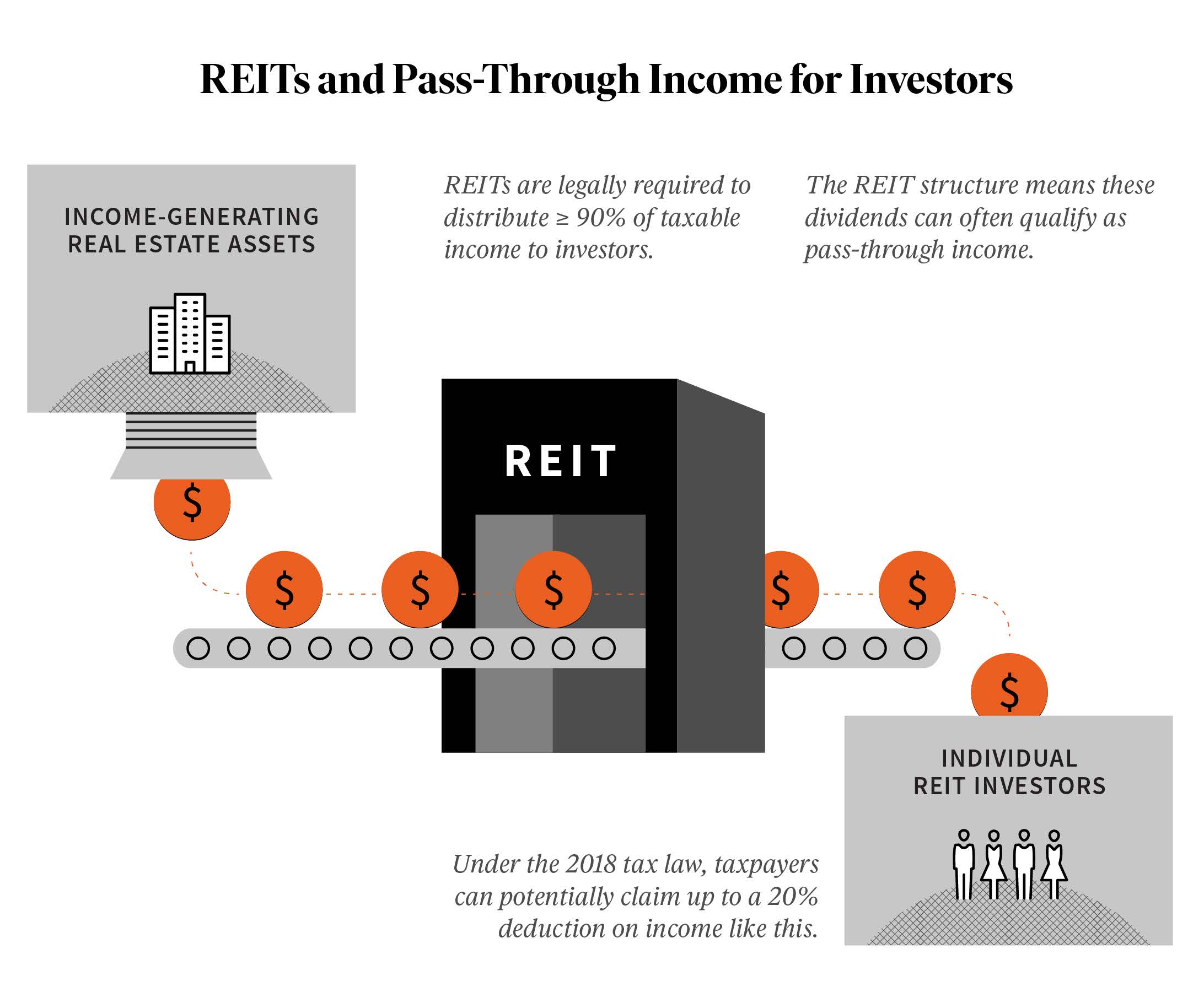

- REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends.

- Income generated from real estate properties owned by REITs is not subject to corporate income tax at the entity level, as long as they meet the requirements set by the IRS.

Benefits of Investing in REITs for Individual Investors

Investing in REITs offers several advantages for individual investors, including diversification, liquidity, and attractive dividend yields.

- Investors can gain exposure to a diversified portfolio of real estate assets without the need for large amounts of capital typically required to invest in individual properties.

- REITs are traded on major stock exchanges, providing investors with liquidity and the ability to easily buy and sell shares.

- REITs often offer higher dividend yields compared to other types of investments, making them an appealing option for income-oriented investors.

Regulation and Taxation of REITs

REITs are regulated by the Securities and Exchange Commission (SEC) and must adhere to certain guidelines to maintain their status as a REIT. Additionally, they are subject to specific tax rules to qualify for favorable tax treatment.

- REITs must invest at least 75% of their assets in real estate and derive at least 75% of their gross income from real estate-related sources.

- They are also required to distribute at least 90% of their taxable income to shareholders in the form of dividends to maintain their tax-exempt status.

- Individual shareholders are taxed on the dividends received from REITs at their ordinary income tax rate, rather than at the lower qualified dividend rate applied to most corporate dividends.

Investing in REITs

Investing in Real Estate Investment Trusts (REITs) can offer various benefits and drawbacks that investors should consider before making a decision.

Advantages of Investing in REITs

- Diversification: REITs provide investors with exposure to a diversified portfolio of real estate assets, reducing risk compared to owning individual properties.

- Liquidity: REITs are traded on major stock exchanges, offering investors the ability to buy and sell shares easily, unlike traditional real estate investments.

- High Dividends: REITs are required by law to distribute a significant portion of their income to shareholders in the form of dividends, providing a steady income stream for investors.

Risks Associated with REIT Investments

- Interest Rate Sensitivity: REITs can be sensitive to changes in interest rates, as higher rates can increase borrowing costs and affect property values.

- Market Fluctuations: REITs are subject to market volatility, and economic conditions can impact the performance of real estate assets held by the trust.

Comparing REIT Performance

When comparing the performance of REITs to other investment options, it is essential to consider factors such as risk tolerance, investment goals, and market conditions. Historically, REITs have provided competitive returns compared to stocks and bonds, making them a valuable addition to a diversified investment portfolio.

Factors to Consider Before Investing in REITs

When investing in Real Estate Investment Trusts (REITs), there are several key factors to consider to make informed decisions. These factors can help you evaluate the potential risks and rewards associated with REIT investments.

Property Sectors

Different REITs focus on specific property sectors such as residential, commercial, industrial, or healthcare. It is essential to understand the dynamics of each sector and assess its growth prospects before investing in a REIT. Consider the current market conditions and future trends in the chosen property sector to make a well-informed investment decision.

Management Quality, Real estate investment trusts (REITs) explained

The quality of the management team behind a REIT can significantly impact its performance. Evaluate the experience, track record, and strategic vision of the management team before investing. Look for transparency, good governance practices, and a history of successful property acquisitions and management.

Financial Metrics

Analyzing the financial metrics of a REIT is crucial in assessing its financial health and performance. Key metrics to consider include Funds from Operations (FFO), Net Asset Value (NAV), Debt-to-Equity ratio, and Dividend Yield. Compare these metrics with industry benchmarks and historical data to gauge the REIT’s financial stability and growth potential.

Impact of Economic Conditions

Economic conditions can have a significant impact on REIT investments. Factors such as interest rates, inflation, GDP growth, and market volatility can influence the performance of REITs. Stay informed about macroeconomic trends and assess how these factors may affect the property market and REIT valuations.

Tips for Evaluation and Selection

– Diversify your REIT portfolio across different property sectors to minimize risk.

– Research and analyze the market fundamentals of the property sector before investing.

– Consider the dividend history and growth potential of the REIT to assess its income-generating ability.

– Monitor regulatory changes and industry trends that may affect the REIT’s operations and profitability.

– Consult with financial advisors or experts to gain insights and recommendations on REIT investments.

In conclusion, Real estate investment trusts (REITs) offer a unique investment avenue with potential benefits and risks to consider. Whether you’re looking for diversification, high dividends, or a way to navigate market fluctuations, REITs can be a valuable addition to your investment portfolio. By understanding the key factors and strategies Artikeld in this guide, you can make informed decisions when exploring the world of REIT investments.

When looking to create a balanced portfolio, one of the key components to consider is investing in the best mutual funds. These funds offer a diversified approach to investing, spreading risk across various asset classes. To help you make informed decisions, check out this list of best mutual funds for a balanced portfolio that can help you achieve your financial goals.

When it comes to building a balanced portfolio, choosing the best mutual funds is crucial. By diversifying your investments across various assets, you can mitigate risk and potentially increase returns. To help you make informed decisions, consider exploring these top options for best mutual funds for a balanced portfolio that align with your financial goals and risk tolerance.