Top performing mutual funds 2024: Step into the world of finance and explore the top investment opportunities that will shape your financial future. From expert management to lucrative returns, find out what sets these funds apart from the rest.

Mutual funds offer a diverse range of investment options, each with its own strategy and potential for growth. Understanding the key factors to consider when choosing mutual funds can help investors make informed decisions and maximize their returns.

Overview of Mutual Funds: Top Performing Mutual Funds 2024

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make decisions on behalf of the investors.

By 2025, cars with advanced technology will dominate the roads, revolutionizing the way we drive. From self-driving capabilities to integrated smart features, these vehicles are set to redefine the automotive industry. Check out the latest trends and innovations in 2025 cars with advanced tech to stay ahead of the curve.

Types of Mutual Funds

- Equity Funds: These funds primarily invest in stocks and are suitable for investors seeking long-term capital growth.

- Bond Funds: These funds invest in fixed-income securities like government or corporate bonds, providing income through interest payments.

- Index Funds: These funds aim to replicate the performance of a specific market index, offering diversification at a low cost.

Benefits of Investing in Mutual Funds

- Professional Management: Mutual funds are managed by experienced professionals who make investment decisions based on research and analysis.

- Diversification: By investing in a mutual fund, investors gain exposure to a wide range of securities, reducing the risk associated with individual stock picking.

- Liquidity: Most mutual funds allow investors to buy or sell their shares on any business day, providing liquidity compared to individual securities.

Management of Mutual Funds

Mutual funds are managed by fund managers who oversee the investment strategy, asset allocation, and buying/selling of securities within the fund. These managers aim to achieve the fund’s investment objectives and generate returns for investors.

By 2025, cars with advanced tech are expected to dominate the roads, revolutionizing the way we drive. From self-driving features to enhanced safety systems, these vehicles are set to redefine the automotive industry. Check out this list of 2025 cars with advanced tech to stay ahead of the curve and experience the future of transportation.

Factors to Consider When Choosing Mutual Funds

When selecting mutual funds, investors should consider various key factors to make informed decisions about their investments. These factors play a crucial role in determining the performance and suitability of mutual funds for individual financial goals.

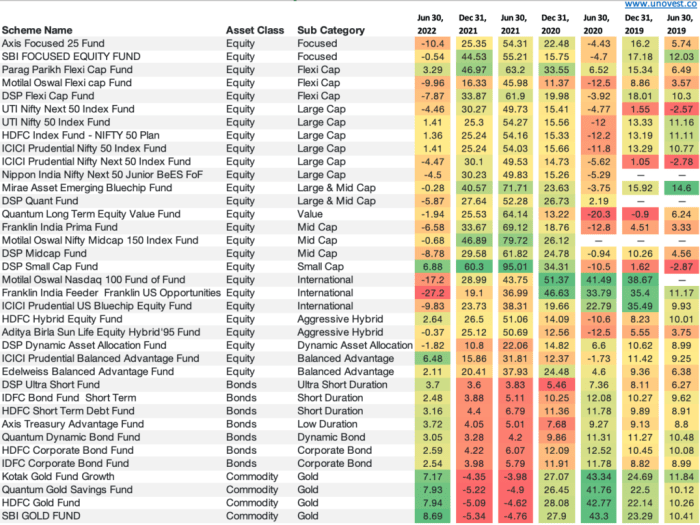

Performance History Comparison

- Investors should analyze the historical performance of different mutual funds to assess how they have fared in various market conditions.

- Comparing the returns of mutual funds over different time periods can provide insights into their consistency and ability to deliver long-term gains.

- Examining benchmarks and peer group comparisons can help investors evaluate the relative performance of mutual funds within their respective categories.

Importance of Expense Ratios and Fees

- Expense ratios and fees can significantly impact the overall returns of mutual funds, as higher costs can erode gains over time.

- Investors should pay attention to expense ratios and fees to ensure that they are not overpaying for the management of their investments.

- Choosing mutual funds with lower expense ratios can lead to higher net returns for investors in the long run.

Role of Risk Tolerance

- Understanding one’s risk tolerance is essential when selecting mutual funds, as different funds carry varying levels of risk.

- Investors with a higher risk tolerance may opt for funds with greater potential for returns but also higher volatility.

- On the other hand, investors with a lower risk tolerance may prefer more conservative funds that prioritize capital preservation over aggressive growth.

Top Performing Mutual Funds in 2024

In 2024, several mutual funds have stood out for their exceptional performance, outperforming industry benchmarks and delivering impressive returns to investors. Let’s take a closer look at some of the top-performing mutual funds and the factors behind their success.

Factors Contributing to Success, Top performing mutual funds 2024

- Strong Fund Manager Expertise: The top-performing mutual funds often have experienced and skilled fund managers who make strategic investment decisions.

- Diversified Portfolio: These funds maintain a well-diversified portfolio across various sectors and regions, reducing risk exposure.

- Consistent Performance: Consistency in delivering positive returns over different market conditions is a key factor in their success.

- Market Trends Alignment: Successful funds adapt to changing market trends and capitalize on opportunities swiftly.

Comparison to Industry Benchmarks

- The top-performing mutual funds have consistently outperformed industry benchmarks such as S&P 500, Dow Jones, or NASDAQ, showcasing their superior performance.

- These funds have been able to generate higher returns for investors compared to the broader market indices.

Sectors or Regions of Excellence

- Technology Sector: Many top-performing mutual funds have excelled in the technology sector, benefiting from the growth of disruptive technologies and digital transformation.

- Healthcare Industry: Funds focusing on healthcare have shown strong performance, driven by innovation, demographic trends, and global health concerns.

- Emerging Markets: Some funds have capitalized on opportunities in emerging markets, where rapid economic growth and favorable demographics offer attractive investment prospects.

Emerging Trends in Mutual Fund Investments

In 2024, the mutual fund industry is experiencing several emerging trends that are reshaping the landscape of investments. These trends are influenced by various factors such as technological advancements, changing investor preferences, and global economic conditions.

Impact of Technology on Mutual Fund Investments

Technology has revolutionized the way mutual fund investments are made and managed. The rise of robo-advisors and automated investment platforms has made it easier for investors to access and invest in mutual funds. Additionally, advancements in artificial intelligence and machine learning have enabled fund managers to analyze data more efficiently and make informed investment decisions.

Sustainable or ESG-focused Mutual Funds

There is a growing interest in sustainable and ESG-focused mutual funds among investors. These funds prioritize environmental, social, and governance factors in their investment strategies, appealing to investors who want to align their investments with their values. As sustainable investing continues to gain traction, more mutual fund companies are launching ESG-focused funds to meet this demand.

Global Economic Conditions and Mutual Fund Trends

Global economic conditions play a significant role in shaping mutual fund trends. Factors such as interest rates, inflation, and geopolitical events can impact the performance of mutual funds. In 2024, investors are closely monitoring economic indicators and adjusting their investment strategies accordingly to capitalize on emerging opportunities and mitigate risks in the market.

In conclusion, Top performing mutual funds 2024 showcase the potential for strong returns and growth in the ever-changing landscape of finance. By staying informed and analyzing trends, investors can position themselves for success in the coming years.